Should Accounting Firms Use Nifty for Project Management?

Nifty aims to be an all-in-one solution. It includes chat features, project management, goals, document storage, and tasks in a single application. The focus is milestone driven, which works well for large projects and multi-disciplinary teams.

So is Nifty a good fit for your accounting practice?

There is a push for accountants to embrace more technology and tools that streamline processes. Most accountants have ditched paper files and moved to paperless and cloud-based solutions. Paperless is great—but it requires you to have a system for tracking your projects.

Technology has made it easier than ever to interact with clients via multiple channels. The greater accessibility and ease of reaching their accountants means clients are asking for additional services and a more comprehensive range of solutions from their accountants.

Finding the right project management for your firm may mean testing several programs to ensure you’ve found the best fit. The applications need to be easy to use, easy to learn, and integrate seamlessly into your existing (or future) workflows.

Nifty is a contender among accounting project manager apps. This article will look at the software’s benefits and drawbacks to see how it works for accounting firms.

It will also rank some alternative options and look at them alongside Nifty so you can see where the program excels and where it falls short.

Options for Project Management for Accounting Firms

As your firm grows, you’ll find yourself spending more and more time juggling tasks, making it easy to lose track of projects. This is true in any growing business, and it’s especially true for accounting firms that handle accounting for multiple clients with various deadlines.

When you’re working alone, you have a good idea of what projects are due. However, as your team grows, it can be harder to monitor what everyone is working on.

There are several options for handling project management. You can keep to-do lists on paper (or spreadsheets) or implement project management software.

While paper and spreadsheets may work for small teams, a workflow management system can automate many repetitive accounting tasks.

Let’s look at how each of the options stacks up.

Spreadsheets and Manual Checklists

Spreadsheets and to-do lists work great for a single person with a reasonable number of tasks. But as your business grows, lists can become unwieldy.

As soon as you add team members and more clients, to-do lists become less effective for managing your projects.

The best tools augment solid processes that already exist. If you’re still in the early stages, ensure you’re certain about the timeline of events in every client engagement. One day, you can build that into the workflow tool you choose.

For accountants that have moved to automated solutions, 30% of businesses found they saved money, and 44% found they saved time.

Workflow Software for Accounting Firms

Once you’ve reached the point where spreadsheets are no longer an adequate solution, you need to implement workflow management software for your team. You’ll want to ensure you’re picking the right software so you’re not wasting time learning and integrating a series of less-than-ideal solutions.

The most important aspect of a project workflow management solution for accountants is having a set of predefined templates that allow you to hit the ground running. Software that comes with predefined templates for accountants was built with them in mind and is more likely to meet your needs and seamlessly integrate into your existing workflows.

Some of the top accounting firm workflow software options include Jetpack Workflow, Aero Workflow, Canopy, and Karbon.

Users of Aero Workflow have generally considered it to have an outdated (and not user-friendly) interface. Canopy and Karbon have steep learning curves and steep prices.

Jetpack Workflow is a straightforward, modern solution that more than 6,000 real accountants use to manage the flow of projects and tasks in their growing firms.

General Project Management Software

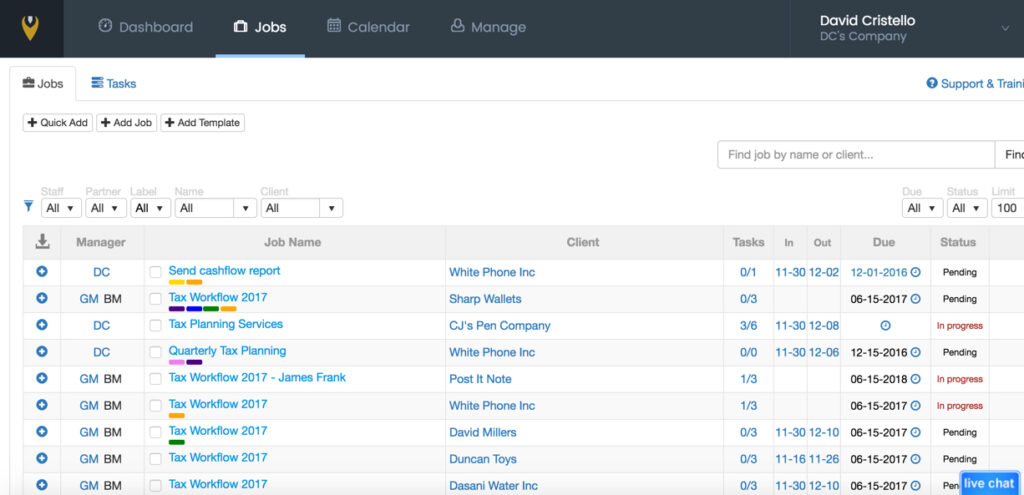

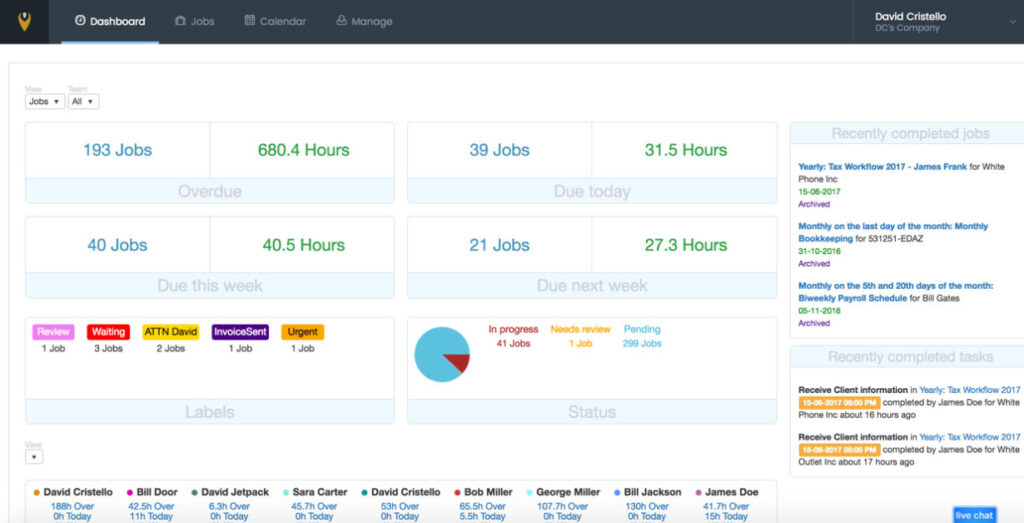

Nifty is a general project management tool meant to work for companies in various industries. It attempts to solve multiple problems for companies, including communication and workflow management. Unfortunately, by trying to accomplish everything, it falls a bit short on workflow management, and the solution is not specific to accounting firms.

What is the defining difference between Nifty and other project management solutions? Nifty does not have any specific templates for accounting professionals. You would need to spend the time to create each of your workflows from scratch, which creates another barrier to your team’s integration of a new project management tool.

How Nifty Works

Nifty works similarly to other project management systems. The initial registration is free, and there is no ongoing expense for the basic account.

If you need additional features such as time tracking and reporting, you’ll need to upgrade to one of the higher tiers. To receive the highest level of support (which includes phone support), you’ll need to upgrade to the highest tier. At the time that this article was published, it cost $16 per user per month.

Next, you’re going to:

- Create a new project. The free tier only allows you to have two projects. You should carefully consider how you want to structure your practice.

- Within each project, you can chat, create task lists, and track time (if you have an upgraded plan).

- Team members can mark items as complete or add notes to existing projects.

For customer support, they provide live chat and phone support. The highest tier plan includes a dedicated resource for technical support.

Best Nifty Alternatives for Accounting Firms

As a general project management program, Nifty accomplishes its goals. However, you may want to consider a tool built with accounting tasks in mind. Accounting work is unique in its strict deadlines and the number of recurring tasks.

Below is a list of the best tools for accounting practices.

Best Overall Accounting Workflow Tool

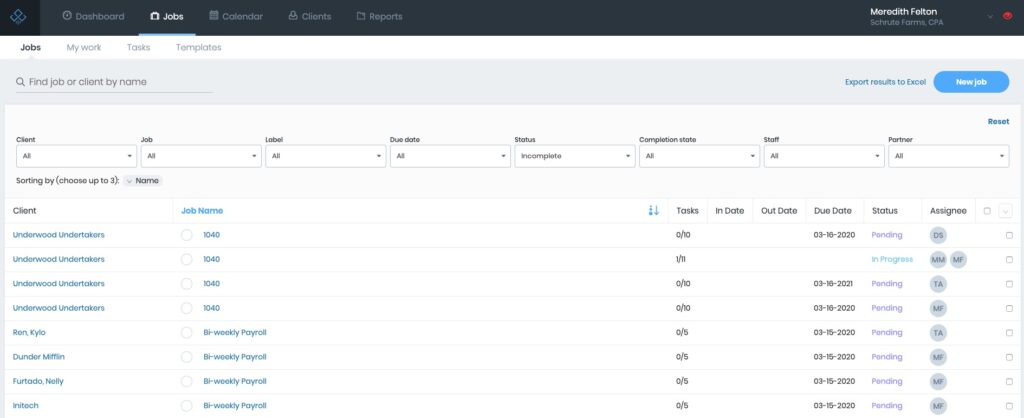

Jetpack Workflow was built from the ground up with accountants and bookkeepers in mind. Every aspect of the program is tailored to the nature of accounting tasks.

You’ll start with more than 70 predefined templates, which means you can have your firm up and running shortly after signing up. If the templates aren’t quite aligned with your team’s workflow, you can easily customize them to meet your needs. You’ll be able to track your team’s progress and monitor their workflows within the system.

Jetpack Workflow offers a free 14-day trial to let you see how well the system works for your team. It also has flexible pricing options starting at $36 per user per month. You can use the time tracking system for invoicing your clients, saving you time and getting you paid faster.

Best Enterprise Audit and Tax Solution

Some accounting practices, such as tax and audit practices, are responsible for meeting hard deadlines, with work requiring constant communication with clients. These firms need to monitor and track communications with several team members in a centralized location.

Karbon is often recommended for complex projects and large teams due to its enterprise-level solutions. However, for smaller teams, the learning curve is very steep, and the interface is not intuitive. Add in the hefty price tag, and you’ll find this is not an ideal solution for small firms. It can be a powerful tool for large teams working in multi-discipline companies with the time to devote to learning new software.

For tax consultants working on a schedule heavily driven by deadlines, ensuring you have a platform to manage the back and forth between you and your clients in advance of due dates is key.

Best Accounting Client CRM Platform

If your firm markets heavily and proactively reaches out to clients, you may want to consider a strong customer relationship management (CRM) platform. While CRM software is great for tracking these types of interactions, the systems often have weak workflow management modules.

If your focus is CRM, Canopy might work for you. The platform tries to solve a variety of needs and is known for handling a little bit of everything. Just keep in mind that the workflow management module is not its primary focus, and you’ll need to figure out ways to make it work for your accounting practice.