9 Useful Daily Bookkeeping Checklist Items (+ Free Templates)

Many bookkeeping tasks follow weekly, monthly, or quarterly accounting cycles. However, if you’re a full-charge bookkeeper or your clients have a large number of transactions, there are several tasks you should complete each day.

We’ve created a list of nine daily bookkeeping tasks to help ensure your clients’ books are up to date every day of the year.

9 Key Daily Bookkeeping Tasks to Include in Your Checklist

1. Make Daily Deposits

A bookkeeper’s job is to keep track of all the money that flows in and out of your clients’ accounts. This helps your clients know how much money they have to work with at any given time. Making daily deposits is a crucial part of the bookkeeping process because it ensures that all money is accounted for, preventing any confusion over where it came from or went.

Completing this daily task allows you to build a good relationship with the bank and establish a paper trail in case any questions arise about a company’s finances. Overall, making daily deposits goes a long way toward keeping your clients’ finances in order.

2. Summarize Cash Sales

Cash sales are the backbone of any business. It’s important to summarize them accurately on a daily basis. This task ensures you’ve accounted for all income and properly tracked expenses.

By summarizing cash sales, your clients can gauge their performance over time and identify any trends. Without accurate summaries, they would have a difficult time managing their finances and making informed decisions about their future. This essential task assists your clients in making vital financial adjustments when needed.

3. Record Bank Transactions

Transactions that occur within a business must be carefully recorded to maintain accurate financial reports and records. Recording financial transactions daily helps you maintain an up-to-date record of your clients’ accounts. It allows you to identify and correct any errors or discrepancies in a timely manner.

Additionally, recording transactions assists in preventing fraud and theft by providing a clear audit trail. Ultimately, this daily task ensures the accuracy and integrity of your clients’ financial records.

4. Categorize Transactions

Every transaction must be properly documented and classified. You need to confirm all entries get recorded in the correct categories. Completing this daily task lets you quickly identify and correct any errors and prevent problems down the line due to a misplaced entry.

5. Record Accounts Payable Invoices

Any bookkeeper knows one of their key responsibilities is recording accounts payable invoices daily. This task is important for a few reasons.

First, it enables you to verify all invoices are accounted for and paid promptly. Second, it prevents late fees and other penalties from accruing. Finally, it provides a clear record of spending that can be helpful in budgeting and financial planning.

6. Review Accounts Receivable

Keeping a close eye on accounts receivable is crucial. Reviewing these items, such as unpaid invoices, on a daily basis allows you to keep track of who owes you money and how much.

This information is essential for managing your cash flow and ensuring that your business is running smoothly. By proactively reviewing accounts receivable regularly, you can quickly identify discrepancies or issues that need to be addressed. You can manage your finances more effectively and avoid problems arising down the road.

7. Update Payroll Records

Maintaining accurate payroll records for your clients is essential. However, it can be a challenge to keep up with the paperwork on a daily basis.

Fortunately, there are a few simple ways to stay on top of your payroll duties. First, keep detailed records of the hours each employee works. Doing this ensures everyone is being paid correctly.

Additionally, be sure to update your records regularly so you can catch any errors. Lastly, keep a copy of each employee’s most recent pay stubs on hand so you can reference them if any questions arise.

By following these simple tips, your clients’ payroll records will always be accurate and up to date.

8. Check Upcoming Deadlines

Maintaining financial records requires a high degree of accuracy and attention to detail.

One of the most important items on your checklist is staying on top of deadlines. Each month, there are a number of deadlines you need to meet to keep your clients’ books in order. These can include filing payroll taxes, sending invoices, and reconciling credit card accounts.

Missing just one deadline can create a ripple effect,throwing off your entire system. That’s why you must be aware of upcoming deadlines and plan accordingly to keep your clients’ finances in order.

9. Review Your Clients’ Cash Position

Tracking your clients’ cash position means knowing how much money their company has on hand at any given time and making sure expenses get paid on time.

Reviewing the cash position regularly helps prevent any future financial issues. For example, if you know your client only has a certain amount of cash on hand, you can be more careful about how it is spent.

Keeping tabs on your clients’ cash position ensures bills are paid, vendors are happy, and your clients can relax knowing their financial affairs are running smoothly.

Free Templates: Weekly and Monthly Bookkeeping Checklists

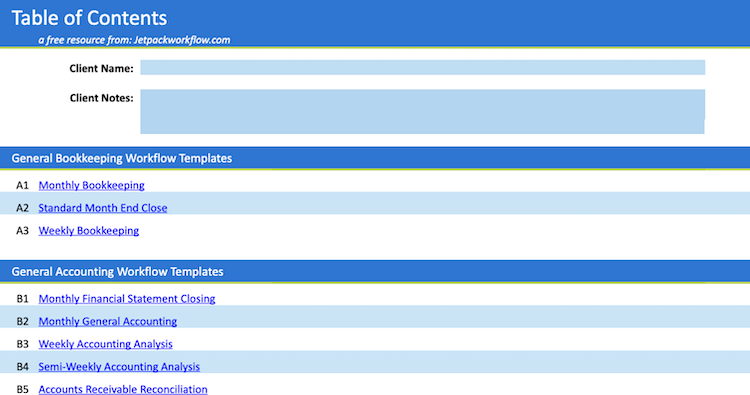

If you’re looking beyond your daily workflow and need some weekly and monthly bookkeeping checklists, Jetpack Workflow has 32 free templates for bookkeeping and accounting firms so you and your team never let any task slip through the cracks.

Best Methods for Tracking Your Daily Bookkeeping Checklist

You have a few options when it comes to keeping tabs on your daily bookkeeping checklist.

1. Pen and Paper

Pros

- Classic, no-cost choice

- Easy to create

- Travels with you

Cons

- Easily misplaced or lost

- Hard to share with a team

- Difficult to edit or reprioritize

2. Google Document or Spreadsheet

Pros

- Free

- Shareable with others

Cons

- No access to reminders

- Not built with bookkeepers in mind

- Requires creating templates

- Doesn’t sync with other software

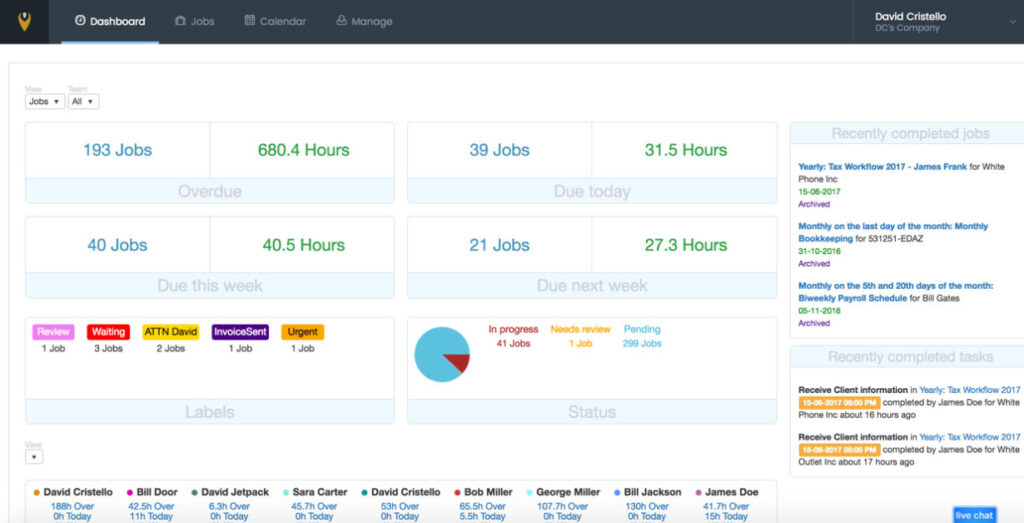

3. Jetpack Workflow

Pros

- Designed for bookkeepers

- Premade, predefined templates

- Offers reminders

- Easy to share

- Robust reporting

- Responsive customer service

- Works with other software

Cons

- Not free, but very affordable

Interested in finding out how Jetpack Workflow can improve your firm’s productivity? Learn more here.