Organizational Structures for All Sizes of Accounting Firms

Looking for inspiration on how you should structure your accounting practice as your firm grows? A well-defined organizational structure helps ensure your firm completes tasks efficiently and effectively and delivers the highest quality services to your clients.

Choosing the most suitable business structure can vary depending on your firm’s size and long-term goals. In this article, we’ll look at some standard structures by business size to help guide you on the best way to align your team.

Small Firm Organizational Structure Example (0–5 Employees)

A small accounting firm typically has a straightforward organizational structure with a clear hierarchy of roles and responsibilities. The structure can vary depending on the firm size, the type of services offered, and the number of employees.

At the top, you typically find the owner or founder. This person is responsible for the overall management and decision-making and may also be involved in client relations and perform high-level accounting tasks.

Below the owner or founder is a manager or partner who oversees the firm’s day-to-day operations. Their responsibilities include managing staff, handling finances, and ensuring their clients receive quality service. They also may be involved in business development and client relations.

Next in the hierarchy are the staff accountants or associates who perform much of the accounting work. They are responsible for preparing financial statements, performing audits, preparing tax returns, and providing general accounting services to clients.

Depending on the size of the firm, there may also be an office manager or administrative assistant who tends to daily administrative tasks such as scheduling appointments, maintaining records, and handling correspondence.

The size and complexity of a small accounting firm often determine the number of employees in each role, but the structure is typically consistent with the roles described above.

Medium Firm Organizational Structure Example (6–15 Employees)

In a medium-sized accounting firm, the organizational structure can vary depending on its size, growth plans, and business goals. However, the structure for a typical medium-sized accounting firm with 10–15 employees might have the characteristics listed below.

- Partner(s): One or two partners lead the firm and make decisions on the direction and strategy of the business. They are responsible for the firm’s success and oversee its financial performance, client relations, and team management.

- Manager(s): One or two managers report to the partners and supervise the work of the firm’s associates. They are responsible for ensuring the timely completion of projects, meeting budget goals, and taking care of client needs. They also work closely with the partners on the development and implementation of the firm’s strategy.

- Associates: Three to five associates report to the managers and carry out day-to-day tasks, such as preparing financial statements, tax returns, and other accounting-related projects. They also provide support to clients and help managers with larger projects.

- Office Manager: An office manager handles the administrative work of the firm, including overseeing office operations, managing staff, and ensuring daily activities run smoothly. They may also help manage the firm’s finances and ensure compliance with regulatory requirements.

The partners and managers provide leadership and guidance to the associates, and the associates offer their support and expertise to the clients. Everyone cooperates to achieve the firm’s goals and provide the best possible service to clients.

Large Firm Organizational Structure Example (15+ Employees)

The organizational structure in a large accounting firm is typically more complex and hierarchical. There may be multiple departments or teams, each with its own management structure and reporting lines. A typical organizational structure for a large accounting firm might include the characteristics listed here.

- Partners: Situated at the highest management level, partners are responsible for setting the firm’s direction and making critical business decisions. Depending on the size and structure of the business, there may be two to four partners in a large firm.

- Directors or Managers: Found at the next level of management, these senior associates are responsible for overseeing one or more departments or teams within the firm. Depending on the firm’s size, there may be four to 10 directors or managers.

- Team Leaders: The first level of management within a specific department or team, team leaders are responsible for overseeing a group of employees and ensuring their work is completed on time and at a high standard. There may be two to three team leaders in each department or team.

- Associates: These employees carry out the day-to-day work of the firm, such as preparing financial statements, managing client relationships, and conducting audits.

- Support Staff: The administrative and support employees who provide essential services to the rest of the firm, such as HR, IT, and office management.

This organizational structure allows for clear lines of communication and responsibility and helps ensure work is completed efficiently and effectively. However, please note this is just one example. Actual organizational structures can vary widely depending on each firm’s specific needs and goals.

How the Big Four Accounting Firms Are Typically Structured

The “Big Four” accounting firms are among the largest professional services firms in the world. Comprised of Deloitte, PricewaterhouseCoopers, Ernst & Young, and Klynveld Peat Marwick Goerdeler, these companies designed their firm structure to provide a range of services to their clients, including auditing, consulting, and tax advisory services.

The organizational structure of the Big Four accounting firms is typically hierarchical and follows a partner-led model. Partners are the highest-ranking individuals within the firm and are responsible for managing client relationships, leading teams, and making strategic decisions.

Partners typically receive support from a large pool of senior managers, managers, and staff members. Working together, these individuals provide comprehensive services to clients and support the firm’s overall goals.

While each Big Four firm has its own unique structure, it generally consists of several primary departments, including audit, tax, consulting, and advisory.

The audit department is responsible for conducting financial audits and providing clients with assurance services. The tax department handles tax planning and compliance. The consulting department offers strategic and operational advice to clients. Lastly, the advisory department provides risk management, IT advisory, and financial advisory services.

The Big Four may also have specialist teams focused on specific industries, such as technology, financial services, or healthcare. These professionals share industry-specific expertise with clients in those sectors and help meet their unique needs.

Overall, the Big Four accounting firms organize their structure to provide clients with a full range of professional services, from traditional accounting and auditing services to more specialized and innovative offerings. A solid partner-led model, extensive resources, and a focus on their clients’ needs make the Big Four trusted and valued resources for businesses worldwide.

How to Stay Organized Regardless of Your Business Structure

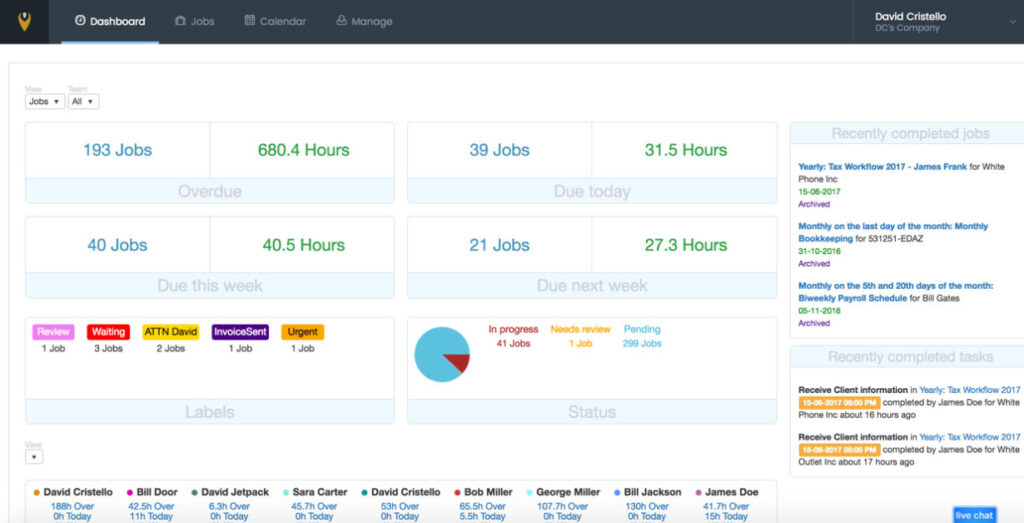

No matter which business structure you decide on, staying organized is essential for providing top-tier service to your clients.

Simplify your processes with our collection of customizable accounting workflow templates. This free resource includes a ton of the most popular accounting templates including monthly bookkeeping, weekly accounting analysis, client onboarding procedures, and common tax return forms.