How Meyer Only Spends Four Hours per Week on Her CPA Firm

Podcast

Summary

- Knowing When to Step Back

- Preparing Your Firm For Less of Your Time

- Mastering Time Blocking

Jackie’s Resources

- Join her Facebook group, Accounting Firm Influencers

- Reach out at cpa@meyertax.com

- Check out her resource guide

- Previous Growing Your Firm Podcasts:

Meet Our Three-peat Guest: Jackie Meyer

Jackie Meyer is the CEO and founder of Meyer Tax, she’s won Forbes 40 under 40, is the founder of a new software app TaxPlanIQ, and an official member of Forbes finance council. On top of all of that, she is also working on her PhD. After meeting with us once to discuss how to run a successful remote accounting firm, she then met with us to explain how she niched down to tax planning which sparked new growth and profitability. Today, Jackie will join us for the third time to walk us through her process of transitioning to a four-hour workweek.

After 10 years of hard work, 100 high net worth execs as clients, and a dozen staff members, Jackie has successfully transitioned to running her firm working just four hours a week. In this podcast, Jackie gives insight into knowing when it’s time to step back, how to prepare your firm for fewer hours on your end, and the art of mastering time blocking. The basis of all of these changes came from mentorship and coaching, so she now runs the program Certified Concierge Accountant for others to accelerate their own firms’ path.

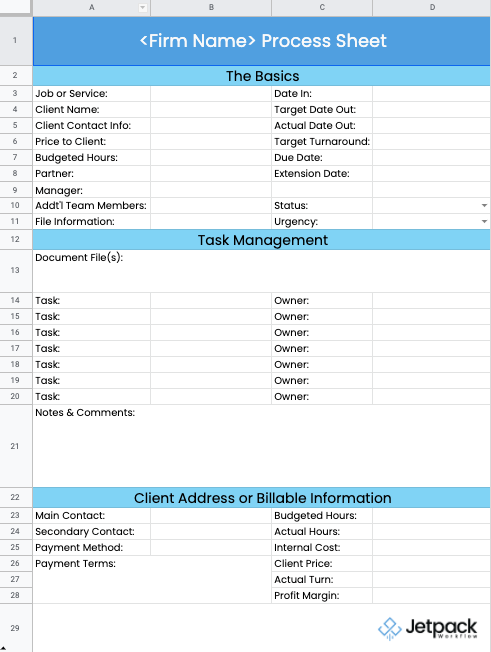

Get everything you need to manage projects and meet deadlines.

Subscribe to our weekly newsletter, and get 32 free accounting workflow templates today!

sign me up!

About two years ago, Jackie was faced with a family crisis that sparked her desire to cut down to a four-hour workweek. She knew her long hours and busy weeks were beginning to be too much so after reading The 4-Hour Workweek by Timothy Ferris, she restructured her firm to be more conducive to her schedule. She also found passion and purpose in helping other accountants find balance and wanted to spend more time developing tools TaxPlanIQ and her Certified Concierge Accountant mastermind.

By niching down to focus on tax planning for high net worth execs, Jackie was able to triple her income and lower her client base by roughly 60%. Once she successfully made her firm more valuable and profitable, she was able to shift her focus to finding people to replace her. Just cutting back, or just converting to value pricing, won’t cut it to stay profitable. There’s a unique combination that needs to be done to stay in the top 1% of net income for accounting firms.

She also noted that when her firm was at a point where they were no longer looking to grow, and just aiming to stabilize revenue, she could start looking for more ways to step back.

Preparing Your Firm For Less of Your Time

If there’s one thing Jackie made clear, it was that there’s always an app or coaching program to help your firm run more smoothly and efficiently. She realized this firsthand through hours of research and trying to solve problems she was continuously running into. She would implement and experiment with multiple apps and programs to find what works best for her firm, and more importantly, saves her and her team the most time.

From there, Jackie emphasized creating and using training videos as aids for her team members. These videos came through in a big way when she transitioned out of her sales role. By recording all of her pitches via Zoom, she was able to teach her tax manager how to make a sale in a way that aligned with Jackie’s approach. After shadowing just a few pitches, the transition was made, and she could check sales off her to-do list, meaning working fewer hours a week.

Jackie acknowledged there were hiccups in getting her firm to where it is now. There were a few bad hires, however, she sees these as a learning opportunity because they showed her what she didn’t want in an employee. She also mentioned the importance of finding your core values early on. You may think the entire staff is on the same page as you when it comes to values but in reality, you don’t know if you don’t make an effort to discuss and implement them. You can then test potential new hires by asking interview questions that require answers parallel to your values, cutting down the number of bad hires.

Mastering Time Blocking

Trimming down a full-time schedule into a four-hour workweek requires excellent time management skills. Jackie credits time blocking to Chuck Bauer and the Certified Concierge Accountant program for a large portion of her success in this area. Her three keys to time blocking are:

- Set Time Limits. Setting time limits gives you a general idea of how long it should take to accomplish a task.

- Say No. Learn to say no to people and tasks that don’t fit into your plan or will consume too much of your time. Finding a mentor/coach is imperative for this confidence.

- Work Backward. Schedule your most important tasks first in the time frames you have available and then see if you have time to complete the minor tasks.

She also mentions that if there is something you are doing that can be delegated or done by an outsourced company, make the hire. For example, Jackie no longer checks her email regularly. Instead, she has a professional organize and sift through emails so she doesn’t have to spend more than 30 minutes a day replying to emails.

By following these tips, Jackie can use her four hours for things like tweaking efficiency tools, analyzing the scorecard sheet, talking with customers, and joining team meetings. She makes sure she is available on instant messenger should her team need her outside of her shortened schedule however, they each have someone to report to if there is a problem, so she is rarely needed.

Jackie has taken all of the right steps to get to the coveted four-hour workweek. By knowing when to step back, preparing the firm for fewer hours, and mastering time blocking, she’s been able to keep the transition smooth while maintaining the same level of revenue and success.

To learn more about Jackie and how she has gotten her firm to where it is, be sure to listen to the full podcast above!