8 Must-Know Best Practices for Client Accounting Services

If you decide to start providing client accounting services (CAS), you may have high hopes of scaling your firm and taking on a more significant role within your clients’ businesses.

However, something firm owners find surprising when offering this service is how the scope of work quickly expands. It can become unmanageable, too resource intensive, and overload your team if not done strategically.

Still, when properly executed, adding client accounting services can be ideal for firms wanting to establish their expertise further and boost profitability.

We met with dozens of firm owners who scaled their operations by adding CAS to discuss their expert recommendations for other firms looking to follow suit.

Below, you’ll find the 8This article shares the best practices your firm can implement for a successful CAS offering.

1. Develop a “Cherished Advisory Practice”

Firms can build a successful CAS offering by determining which services they are passionate about and which are most relevant to their clients.

Doing so allows them to establish a “cherished advisory practice” where clients see value in the personal relationships and trusted expertise they provide and not just the services they offer. As a result, each firm’s CAS offering will vary depending on its own unique circumstances.

Amy Vetter, CEO and consultant at the B3 Method Institute, explained the importance of accountants engaging in services that support their overall mission and purpose.

Instead of including every service possible under the CAS umbrella—bookkeeping, virtual CFO, financial reporting, and more—a more meaningful approach is for firms to focus on their strengths.

Clients can easily find alternative service providers for tasks like tax preparation or controller services. Therefore, firms need to offer value in intangible ways that make them irreplaceable.

Overall, firms that take the “cherished advisory practice” approach can improve client satisfaction and retention rates, supporting their growth over the long term.

You can watch the full podcast episode where Vetter explains the mindset shift required to launch a CAS practice here:

2. Niche Down Your Clientele

On a similar note, firms that niche down and narrow their target market find success with their CAS practice.

When growing your CAS offering, you can easily become overwhelmed by taking on all interested clients simply to expand your business.

However, this can lead to staff burnout, compromised client relationships, and subpar performance due to the workload involved for each new CAS client.

So, while it may seem counterintuitive at first, being selective about your CAS clients helps you develop more meaningful relationships with those you do end up working with.

Plus, your team can expand their expertise in specific areas if your practice has a more specific focus. Take note of your team’s knowledge, preferences, and vision for the firm to help narrow down your niche. Vetter supports this sentiment, saying:

“By sticking with a niche, we gain specific experience to the industry we’ve decided to focus on, which enhances our knowledge of said niche.”

Additionally, niching down allows you to take a more streamlined and efficient approach to your services. You can replicate workflows across the accounts of similar industries or business models rather than creating them from scratch for each new client.

By being more strategic with the clients and industries you serve, you can feel confident in the value you’re providing and the level of productivity you’re achieving.

3. Prioritize Communication and Set Expectations

Given your level of involvement in a client’s business with CAS, communication with these clients will likely look different from other one-off services your firm may offer.

Firms must prioritize communication and transparency from the start of their engagement with CAS clients to help build trustworthy relationships. Firms should be clear about deliverables, timelines, and billing details for all services they plan to provide.

In many cases, your team will work much more closely with CAS clients than you may be used to. Compared to quarterly check-ins with clients for other one-off accounting services, CAS may involve daily or weekly client meetings, regular reporting, and providing frequent updates and insights into their financials.

Some firms even find it necessary to add dedicated roles like full-time or part-time client success managers when they start offering CAS. These employees maintain client relationships and provide personalized support when addressing client issues, questions, or concerns.

Giving clients a direct line of communication with the firm helps establish you as a trusted advisor in their eyes.

When bringing on a new CAS client, clearly set communication expectations and guidelines so they know how to reach you, when your team is available, and what kind of reporting and updates you will provide.

4. Invest in Technology

By embracing emerging technologies, CAS providers can improve efficiency, minimize errors, and add more value for their clients, even when taking on a larger workload.

In fact, a recent study shows that 91% of firm owners believe that technology allows them to focus on their clients more and be more productive.

Lots of cloud-based software, tools, and applications out there claim to help CPA firms manage their practices with more streamlined precision. However, firms should properly research and assess their existing workflows and tech stack to determine the right tools for their needs.

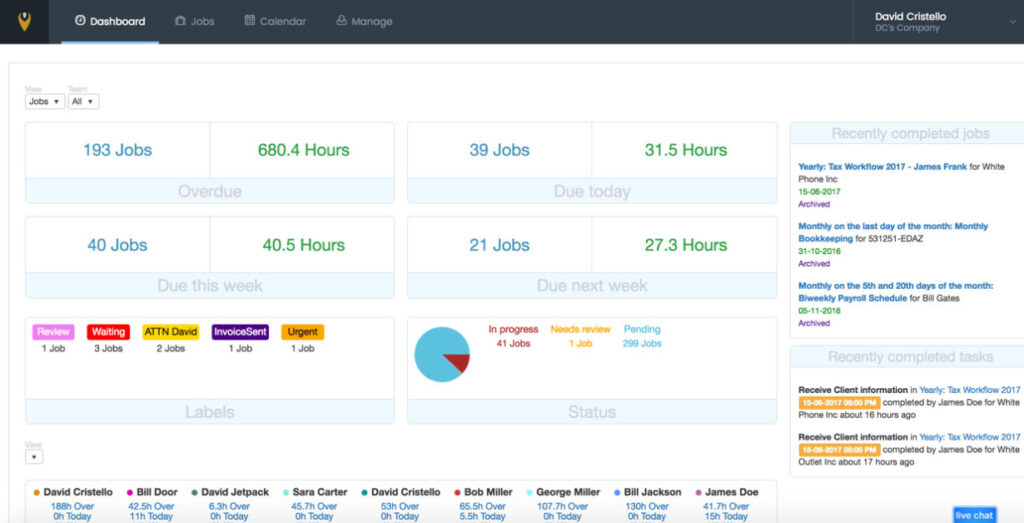

Across the board, using a program like Jetpack Workflow allows CAS firms to tap into the power of automation when building customized checklists, forms, and workflows that their staff relies on daily.

Designed specifically for accountants, Jetpack Workflow helps users cut down on the hours they spend on repetitive administrative tasks. As a result, your staff can devote more of their workday to essential client advisory services.

Managing multiple CAS client accounts is a large and complex task. However, Jetpack Workflow lets you see what every employee is working on, keeping your firm on track and meeting critical deadlines so nothing falls through the cracks.

5. Stay Diligent on Compliance and Accuracy

The regulatory landscape constantly changes, impacting tax plans, business finances, and other accounting matters.

As a CAS provider handling all your clients’ financial and accounting tasks, you need to stay abreast of regulatory changes, developments, and new industry guidelines to ensure compliance at all times.

If found non-compliant, both your client and your firm could face costly fines, legal consequences, and other adverse outcomes. Therefore, CAS firms must prioritize compliance and accuracy at every stage of operations, ensuring workflows and software programs are in place to support these standards.

CAS firms should keep clients’ records and books up-to-date to ensure accuracy. Perform regular audits on client accounts to catch any mistakes or errors before they become serious issues.

Also, be sure all employees are adequately trained and informed on new regulations and guidelines, especially those that directly impact the firm and its clients.

Firms that take compliance and accuracy seriously will appear more reputable and further establish themselves as industry experts.

6. Be Mindful of Your Team’s Capacity

You should know how much work your team can handle if you want to run a successful CAS firm.

Managing all aspects of the accounting work for your client base is a sizable responsibility. You need to ensure you have the internal capacity for each new client while maintaining accuracy and efficiency in your performance.

When you offer client accounting services, it looks much different than providing one-off services like tax preparation or annual financial report preparation.

CAS is much more hands-on in the day-to-day matters of a client’s business. You need your staff readily available if clients have questions about their finances, supplier payments, and payroll processing.

You want to avoid overworking your team and creating employee burnout. However, you have to be responsive to clients and active on their accounts, providing in-depth insights and regular updates to help them make informed business decisions.

Be transparent with your team and ask how much additional work they can handle. Assess how many hours will be required to complete each service you plan on including in your CAS package. You may need to expand the team to support your CAS offering or scale back on other services after careful consideration.

7. Focus on Professional Development

Your ability to offer high-quality and accurate client accounting services largely hinges on the skills and training your staff has received.

Since CAS can have a broad reach throughout your client’s business, you must be confident your staff is well trained and prepared for the high-value work they’ll be completing.

Attracting, hiring, and retaining qualified accounting professionals in today’s environment can be challenging and costly. However, this should remain a central focus of your firm if you want to be successful with CAS.

Once you have a team of professional accountants, do your best to keep them engaged and invest in their professional development, especially if you plan on investing in your technology stack to improve operations. Your staff will need comprehensive training on the new programs and tools to reap the intended benefits.

According to Wolters Kluwer, only 7% of small accounting firms believe they are getting 100% value from their current technology. That’s a significant skills gap firms must address with employees as the space becomes further digitized.

Help your staff stay up-to-date on changing regulations and compliance requirements in the field. Offer continued training and professional development opportunities and encourage them to pursue relevant certification programs so they keep their skills and expertise sharp.

Giving your staff the tools and training they need to be successful in their roles builds their confidence and supports quality service delivery to your clients through that strong performance.

8. Be Committed and Patient

Pursuing CAS opens firm owners to incredible growth opportunities. However, establishing a CAS practice is a big undertaking.

Firms should only take this route if they can devote considerable time and resources to developing their CAS offering.

Some firm owners create a dedicated team that works exclusively with CAS clients. This strategy enables them to focus on delivering high-level strategic services, like cash flow management and compliance services.

However, firms just starting to offer client accounting services may need to get comfortable taking on a more involved role with clients before rolling out more advanced services.

In other words, a firm’s initial CAS offering may mean completing outsourced accounting tasks like accounts payable/accounts receivable management, bill payments, and cash collections. From there, it can add more options, like virtual CFO services.

Building a fully running CAS operation may take time, but the result is rewarding for those who execute it well. To succeed, firms should understand their CAS roadmap, stay flexible, and adapt their client accounting services to evolving market conditions and client preferences.