At Jetpack Workflow, we know accounting firms want to focus on growing their practice. We work hard to provide a solution that helps them standardize their work and automate workflows. We continually release updates to make our platform even more beneficial.

However, we realize we’re not always the right fit for every firm. For example, some firms seek out Jetpack Workflow alternatives because they want practice management software to help them run their entire business.

If you need accounting workflow software to standardize, automate, and track client work – then start your free 14-day free trial of Jetpack Workflow.

Though we’re not the all-in-one practice management platform some firms may need, our mission is STILL to help our customers deliver their best work. So, we wanted to share a few of the Jetpack Workflow options available before making your final decision.

This guide lists 12 top alternatives to consider for your firm. You can see how their features stack up against Jetpack Workflow to find the right platform for your needs.

Practice Management Alternatives

1. Karbon

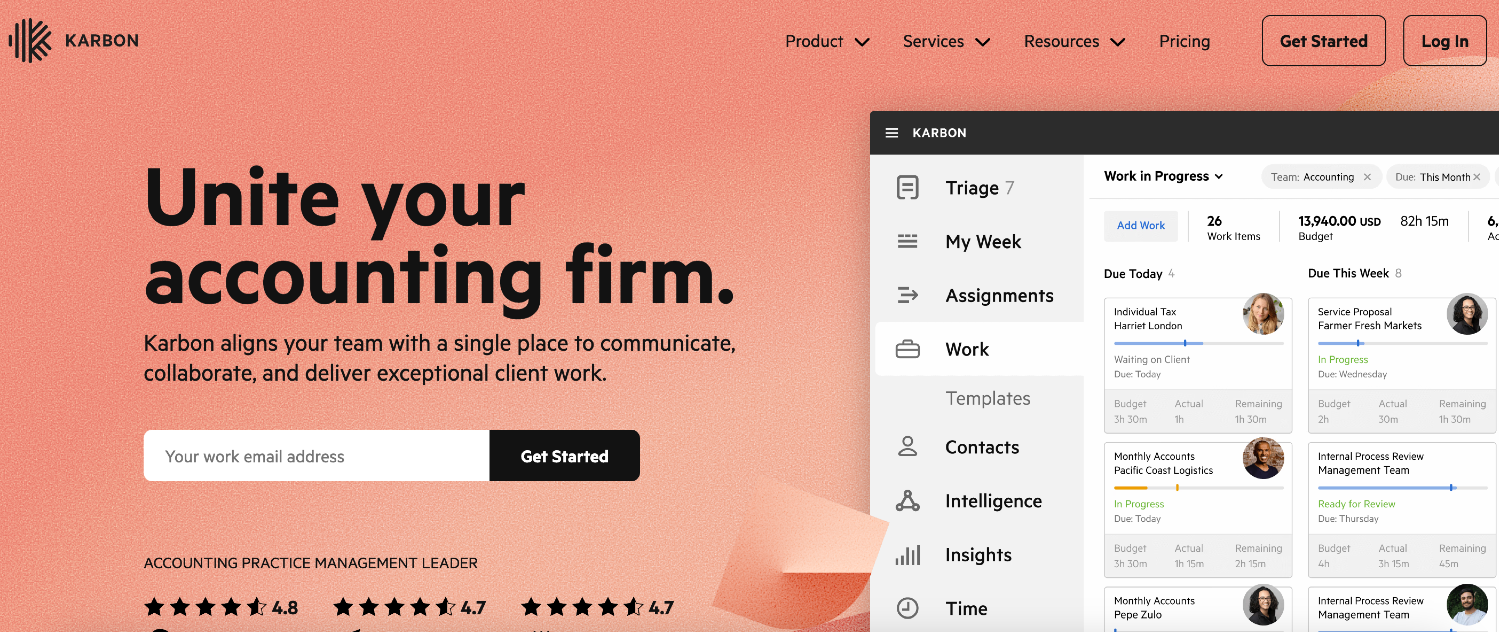

Karbon is a collaborative practice management platform for accounting firms. It lets in-office and remote teams communicate and share workflows.

Karbon’s Key Features

1. Template Creation Tool

Karbon allows users to create custom reusable templates for recurring workflows.

Does Jetpack Workflow have this feature?

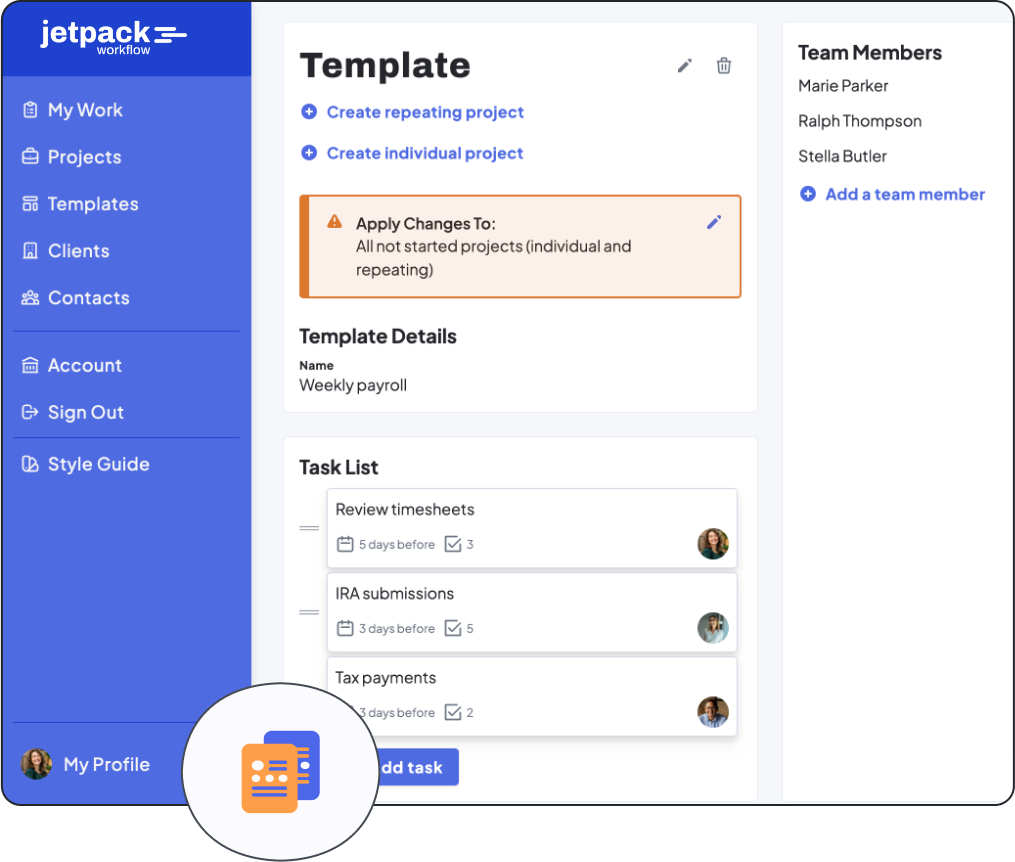

Yes. Jetpack Workflow has a template creation feature for all your accounting workflows. We also make your templates easy to find so you can quickly get to work.

2. Job Tracking

Karbon offers users visibility into which tasks are being worked on, by whom, and when each is due.

Does Jetpack Workflow have this feature?

Yes. Jetpack Workflow makes tracking your team’s progress and planning upcoming projects easy, so nothing falls through the cracks.

Karbon’s Drawbacks

1. Dashboard Not User-Friendly

Some users find the Karbon dashboard isn’t very user-friendly. They wish it had more color and was visually appealing.

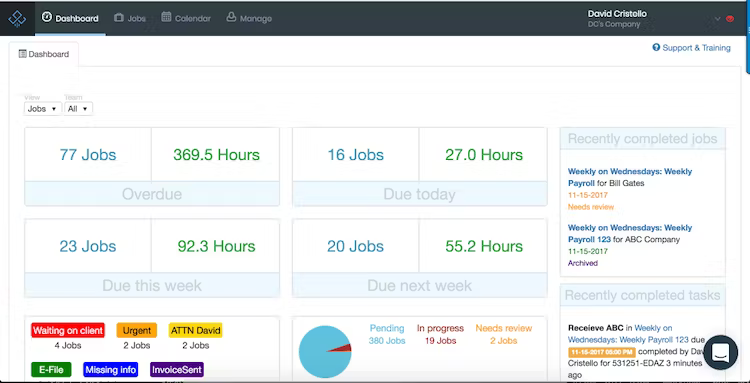

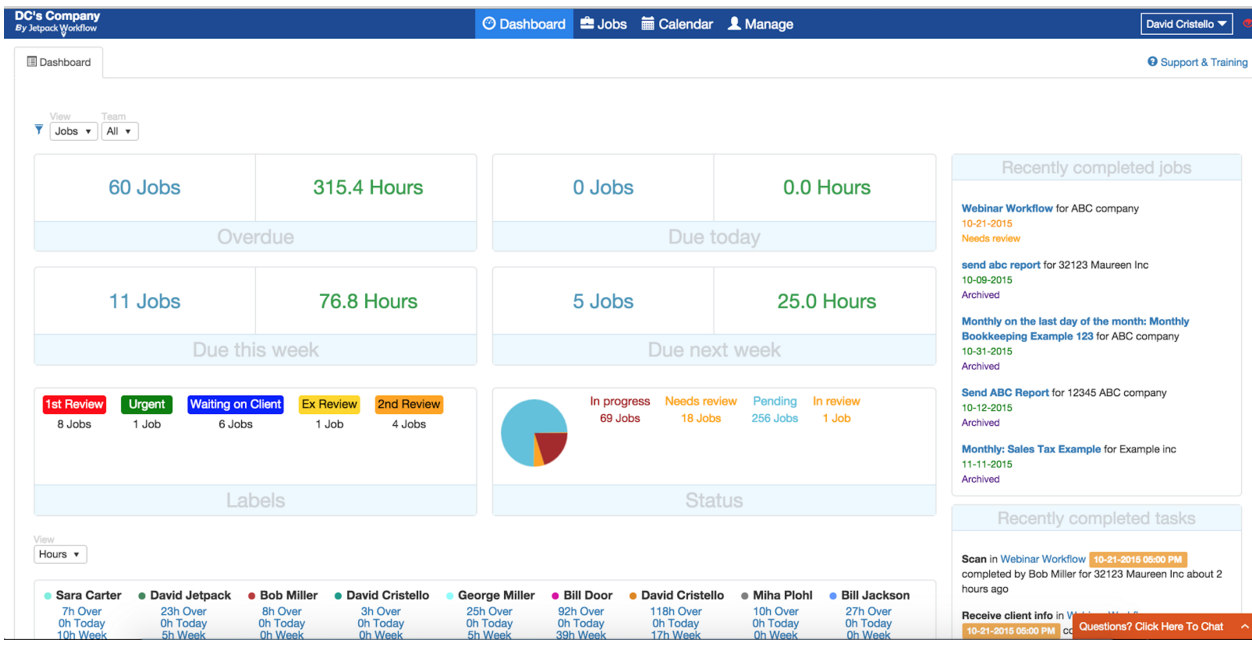

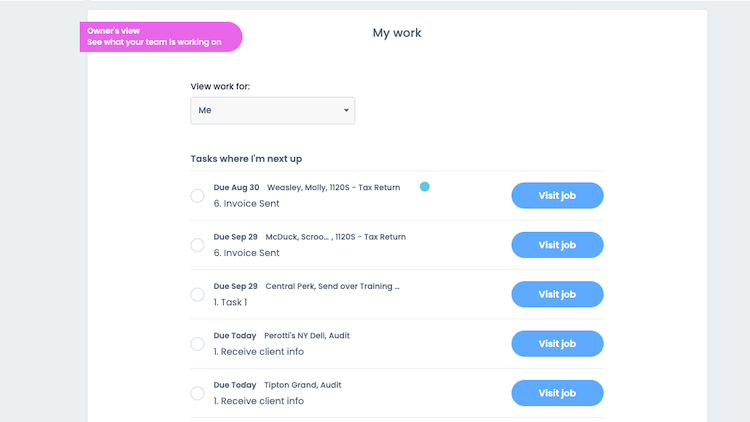

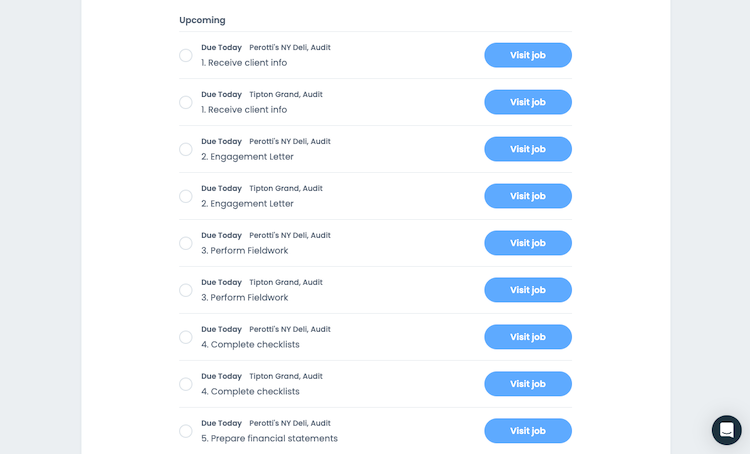

At Jetpack Workflow, we designed our dashboard and related tabs so users can quickly find and review their workflows and tasks, like in this example:

2. Overwhelming Amount of Features

Users sometimes share that the large number of Karbon’s available features means they’re paying for many capabilities they don’t need.

The primary goal at Jetpack Workflow is to help you solve workflow and project management challenges, not bog you down with unnecessary features.

Karbon’s Pricing

Karbon has three plans available. The Team plan is $59/user per month, and the Business plan is $79/user per month, both billed annually. The Enterprise plan has custom pricing for larger teams.

2. Canopy

Canopy is cloud-based accounting practice management software for accounting firms. The platform helps firms manage their practice’s front and back ends.

Canopy’s Key Features

1. Recurring Task Automation

Canopy users can set up automation rules for recurring client tasks at set intervals.

Does Jetpack Workflow have this feature?

Yes. In Jetpack Workflow, you can schedule jobs to repeat automatically using our custom scheduling functions. This tool helps you hit important client deadlines with confidence.

2. Capacity Planning

Canopy has a capacity planning report so users can observe where they deploy resources and assess the workload of each team member.

Does Jetpack Workflow have this feature?

Yes. Our Scale plan has a capacity planning feature for assessing your team’s bandwidth so you can handle changes in demand.

Canopy’s Drawbacks

1. Complex Pricing Structure

Some Canopy users say they have trouble understanding the various pricing plans available and the features included in each.

Jetpack Workflow has two distinct plan options with clear pricing details, so you know exactly what you’re paying for.

2. Glitchy QuickBooks Online Integration

Numerous users report the integration between QuickBooks Online and Canopy can be glitchy and lead to duplicate entries and other inaccuracies.

Jetpack Workflow seamlessly integrates with QuickBooks Online for reliable access to all your accounts.

Canopy’s Pricing

All Canopy plans come with the free Client Management platform that supports up to 500 clients. Additional features are available and paid for separately, such as document management for $40/user per month, workflow management for $35/user per month, and time and billing for $25/user per month.

3. TaxDome

TaxDome is practice management software with client-facing and back-end tools for accounting, bookkeeping, and tax firms.

TaxDome’s Key Features

1. Email Sync

TaxDome allows users to sync their email history and activity. The platform organizes emails by client account rather than grouping them in one combined inbox.

Does Jetpack Workflow have this feature?

You can automatically create tasks by forwarding an email from your inbox to Jetpack Workflow. Countless other email integrations are possible with Outlook and Gmail inboxes using Zapier.

2. Invoicing and Payments

TaxDome users can accept credit card and ACH payments from clients directly through the platform.

Does Jetpack Workflow have this feature?

While Jetpack Workflow users can’t accept client payments directly on the platform, setting up billing through our integration with QuickBooks Online is easy.

TaxDome’s Drawbacks

1. Steep Learning Curve

Because it’s an all-in-one platform, some TaxDome users report a steep learning curve to get started and trained on the vast number of features.

Jetpack Workflow is a dedicated tool for workflow and project management. We try to avoid adding extra features that aren’t practical.

2. Slow Customer Service Response

Some TaxDome users find contacting a customer service representative hard and get directed to the FAQ page first.

Jetpack Workflow has several options for contacting our customer support team, including by phone, email, and chat. We’re proud of our quick response times.

TaxDome’s Pricing

TaxDome’s Lite plan is $33/month, and their Pro plan is $50/user per month. The Lite plan only supports one user, so choose Pro if you have more users and need access to more advanced features.

Legacy Workflow Alternatives

1. Thomson Reuters Practice CS

Practice CS is a practice management tool for accounting firms to manage the administrative side of their business.

Thomson Reuters Practice CS’s Key Features

1. Firm Dashboard

Practice CS users can view work in process (WIP), staff availability, and other real-time reports from their firm dashboard.

Does Jetpack Workflow have this feature?

Yes. In Jetpack Workflow, you can quickly monitor team progress and upcoming work through the “My Work” tab. See what this looks like below:

2. Time Tracking

Employees can track their billable hours from within the Practice CS platform, setting specific tags for individual clients and activities for invoicing purposes.

Does Jetpack Workflow have this feature?

Jetpack Workflow doesn’t currently have a time-tracking feature built into the platform. However, you can easily integrate it into external time-tracking applications like Clockify with Zapier.

Thomson Reuters Practice CS’s Drawbacks

1. Best with Other CS Programs

Some Practice CS users say you can get better functionality from the platform when you use other Thomson Reuters CS programs.

Jetpack Workflow is a robust project and workflow management tool on its own. We can integrate with thousands of other applications like Zapier, which enhances our platform’s capabilities.

2. Clunky and Outdated Design

Users sometimes find the Practice CS user interface to be rather clunky and outdated.

Jetpack Workflow has a sleek and modern design built for forward-thinking accountants and bookkeepers.

Thomson Reuters Practice CS’s Pricing

Contact Thomson Reuters for pricing information on the Practice CS platform.

2. OfficeToolsPro

OfficeToolsPro is accounting practice management software for managing employees, client work, and administrative tasks.

OfficeToolsPro’s Key Features

1. Workflow Automation

OfficeToolsPro allows users to automate repetitive tasks, helping their team members save time on manual activities.

Does Jetpack Workflow have this feature?

Yes. One of Jetpack Workflow’s main features is automating workflows so you can standardize client work and spend more time on billable tasks.

2. Client Portal

The built-in client portals allow clients to upload documents, receive invoices, and make payments through OfficeToolsPro.

Does Jetpack Workflow have this feature?

Our platform is built specifically for project and workflow management, so it doesn’t include a client-facing portal for document uploading or invoicing.

OfficeToolsPro’s Drawbacks

1. Many Unused Features

Users say that while they pay for the many features available on OfficeToolsPro, most go unused.

Jetpack Workflow is a platform dedicated to workflow and project management, with only the essential tools necessary to manage client work and nothing that would make the platform clunky.

2. Lack of Online Tutorials and Training

Some OfficeToolsPro users wish for more online tutorials and training to help them get up to speed on the platform’s many features.

Jetpack Workflow offers lots of available tutorials, videos, and guides on our website, helping you learn how to use the platform.

OfficeToolsPro’s Pricing

Contact OfficeTools directly for pricing details.

3. CCH Axcess Workflow (formerly XCMworkflow)

CCH Axcess Workflow by Wolters Kluwer is a web-based workflow management solution for accounting and tax firms.

CCH Axcess Workflow’s Key Features

1. Professional Tax Software

Users can complete client work on tax returns and related matters through integration with the CCH Axcess Tax tool.

Does Jetpack Workflow have this feature?

Jetpack Workflow does not have native tax software, but you can integrate with various platforms via Zapier.

2. Project Tracking

CCH Axcess users gain visibility over current tasks, including information like the due date and the employee responsible for completing it.

Does Jetpack Workflow have this feature?

Yes. Jetpack Workflow is known for its powerful yet simple-to-use project tracking features. You can keep tabs on what tasks are in progress and who is working on them while monitoring all approaching deadlines.

CCH Axcess Workflow’s Drawbacks

1. Other Tools Required for Full Functionality

Some users report that you can only access the platform’s full functionality by paying for other Axcess tools like Axcess Tax or Axcess Practice.

With Jetpack Workflow, you can integrate with thousands of other applications through Zapier automation. However, our platform is also powerful as a standalone tool that isn’t dependent on other software applications to access our core features.

2. No Free Trial

CCH Axcess Workflow offers no free trial to test the platform’s features and capabilities.

Jetpack Workflow has a 14-day free trial for both of our plans, so you can try them before committing.

CCH Axcess Workflow’s Pricing

Contact CCH Axcess for pricing details.

Traditional Project Management Alternatives

1. monday.com

monday.com is a project management and CRM tool that helps with team collaboration and sales pipeline management.

monday.com’s Key Features

1. Task Management

Users can schedule tasks, assign them to responsible parties, set deadlines, and monitor their progress to completion.

Does Jetpack Workflow have this feature?

Yes. Using Jetpack Workflow, it’s easy to track what each team member is working on and get notified when there’s an approaching deadline.

2. Resource Management

Users can plan and allocate their resources across different projects or tasks.

Does Jetpack Workflow have this feature?

Yes. Jetpack Workflow includes a capacity management feature in our Scale plan.

monday.com’s Drawbacks

1. Difficult to Customize

Many monday.com users report they don’t like the dashboard’s configuration or appearance. They’d prefer more options to customize it.

Jetpack Workflow’s user-friendly dashboard is colorful and appealing, with helpful tabs that make it easy to navigate.

2. Limited Automation and Integrations

Automation and integration features are only available in monday.com’s higher-tier plans, which may not be an option for some users.

At Jetpack Workflow, standard workflow management tools are available with both of our plans.

monday.com Pricing

Monday.com has five plans: a free Individual plan, a Basic plan for $8/seat per month, a Standard plan for $10/seat per month, and a Pro plan for $19/seat per month. An Enterprise plan with custom pricing is available for larger organizations.

2. Asana

Asana is a project management tool popular with companies of all sizes and across various industries.

Asana’s Key Features

1. App Integrations

Asana integrates with over 300 applications, giving users centralized access to all the necessary tools.

Does Jetpack Workflow have this feature?

Through Zapier automation, Jetpack Workflow can integrate with thousands of applications, so you have everything you need right in one location.

2. Workflow Templates

Asana users can standardize their team’s workflows using pre-made templates or create their own templates for recurring workflows.

Does Jetpack Workflow have this feature?

Yes. You can access Jetpack Workflow’s library of over 70 pre-made templates and create custom workflows in just a few clicks.

Asana’s Drawbacks

1. Lengthy Set-Up Time

Users who want to fully customize Asana may spend a great deal of time during the set-up phase to tailor it to their needs.

Jetpack Workflow’s onboarding phase is much faster because we developed it specifically for CPAs, tax professionals, and bookkeepers. We even offer one-on-one onboarding support if requested.

2. Limited Personalized Customer Support

Users of Asana’s free Basic plan (and some users of the paid Premium plan) can only access community support through their online forums and guides, not a customer support agent.

Jetpack Workflow offers a variety of ways to get in touch with our customer support via email, phone, or live chat at any plan level.

Asana’s Pricing

Asana has a free Basic plan that supports up to 15 team members and standard features. The Premium plan is $10.99/user per month for more customization and advanced features. Lastly, the Business plan is $24.99/user per month for more advanced integrations, workload planning, and more.

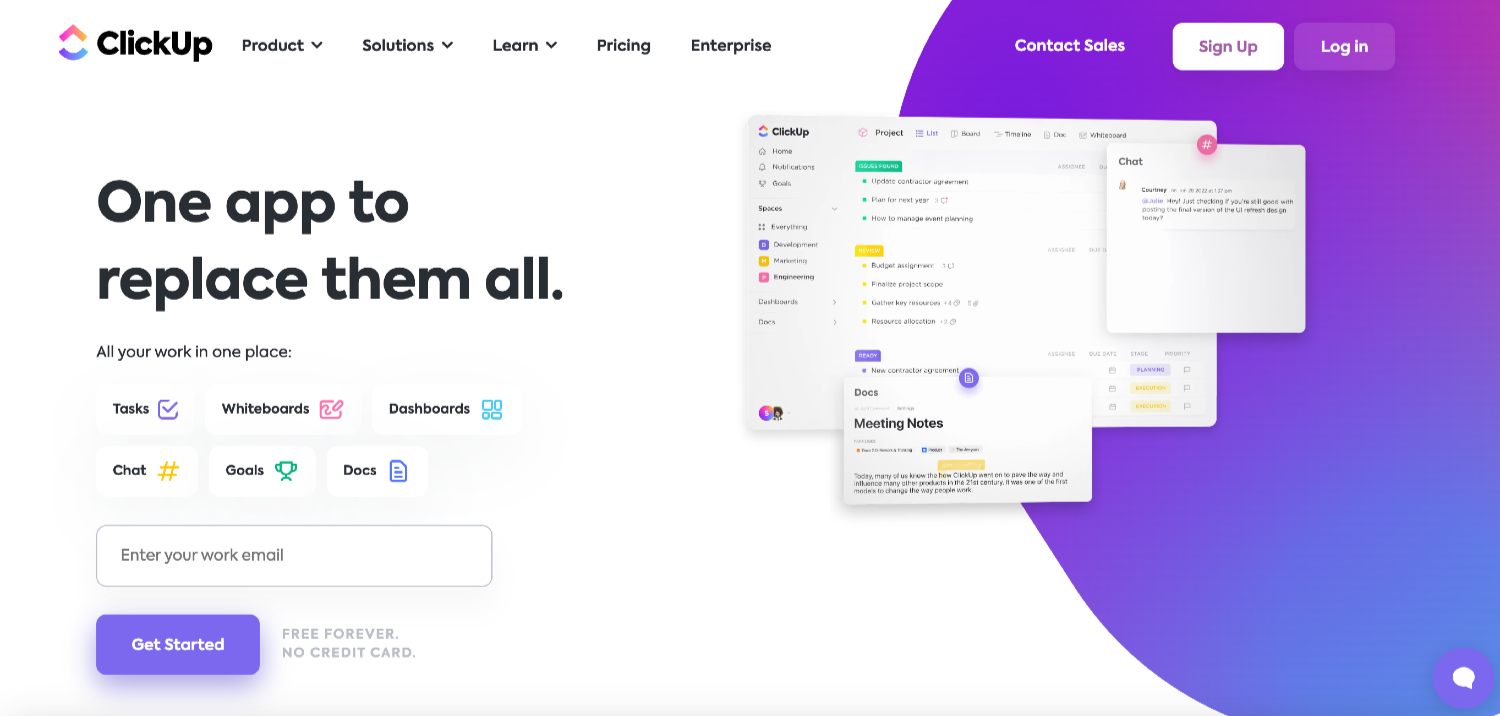

3. ClickUp

ClickUp is a general project management tool used by businesses across different industries.

ClickUp’s Key Features

1. Recurring Tasks

Users can set up recurring task reminders in ClickUp for repetitive client work.

Does Jetpack Workflow have this feature?

Yes. Jetpack Workflow has a similar feature to help standardize and automate repetitive tasks.

2. Task Templates

ClickUp lets users save frequently used workflows as templates for future use to minimize manual administrative work.

Does Jetpack Workflow have this feature?

Yes. Jetpack Workflow lets you either customize your own templates or access the 70+ pre-made accounting templates from our library.

ClickUp’s Drawbacks

1. Lagging Issues

ClickUp users often report lag and slow loading times for the program.

Jetpack Worfklow’s streamlined platform means you can expect fast loading times and less lag during use.

2. Not User-Friendly

Many ClickUp users say the vast number of features on the platform can make it a bit clunky and harder to navigate.

Jetpack Workflow’s tidy and intuitive design makes it easy to use.

ClickUp’s Pricing

For business use, ClickUp offers an Unlimited plan at $7/user per month and a Business plan for $12/user per month, both billed annually. Monthly rates are also available. An Enterprise plan with custom pricing is an option for larger teams.

Direct Competitors to Jetpack Workflow

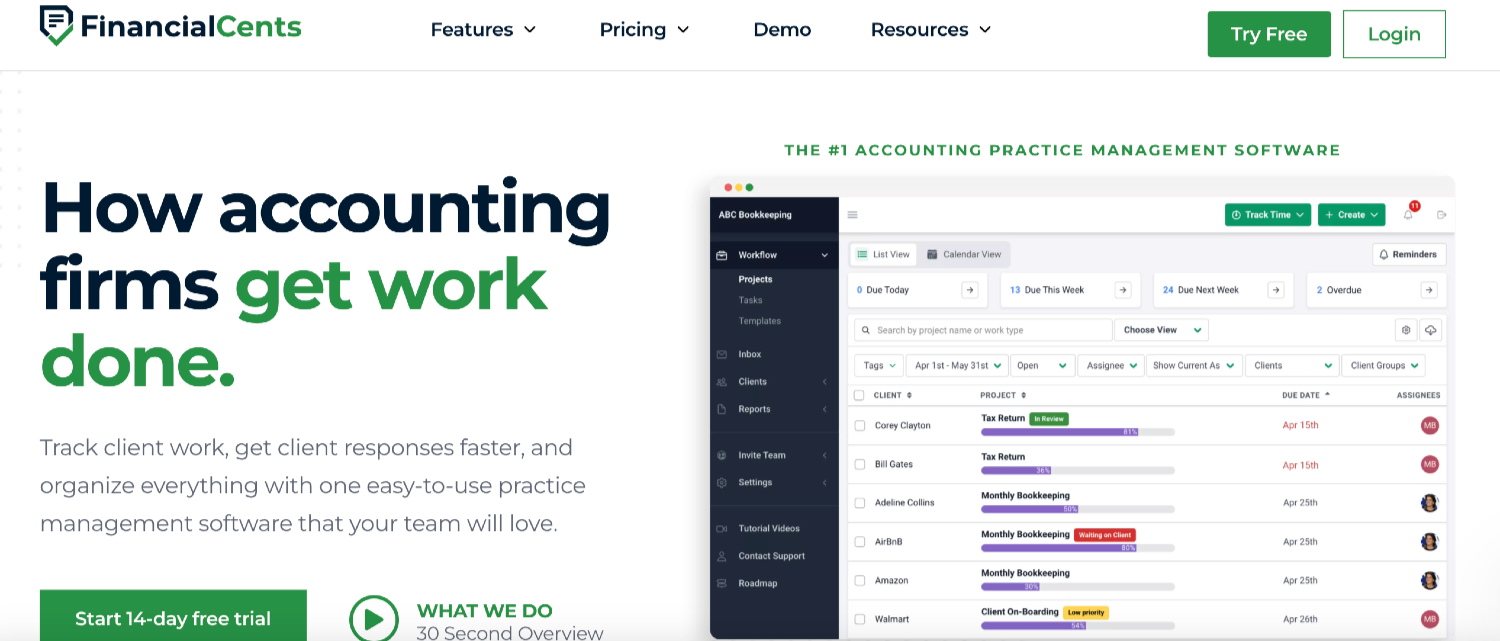

1. Financial Cents

Financial Cents is accounting practice management software that tracks client work and manages client profiles.

Financial Cents’ Key Features

1. Capacity Management

The capacity management feature gives users an overview of their team’s capacity for planning purposes.

Does Jetpack Workflow have this feature?

Yes. Jetpack Workflow’s Scale plan includes a capacity management tool to help you assess your available resources and identify potential bottlenecks before they occur.

2. Workflow Management

This Financial Cents feature lets users see who is working on each task and monitor upcoming deadlines for work still needing completion.

Does Jetpack Workflow have this feature?

Yes. With Jetpack Workflow, you can easily filter, sort, and search through all client projects to assess what each team member is working on and ensure you meet all critical client deadlines.

Financial Cents’ Drawbacks

1. Limited Customer Support

Some Financial Cents users report having their customer service requests funneled to an AI-powered chatbot rather than receiving personalized support from an agent.

Jetpack Workflow offers several ways to contact our support team, which includes phone, email, and chat.

2. Limited Integration

Some users note Financial Cents can only integrate with QuickBooks Online, not other accounting software like Xero.

Through our custom Zapier integration, Jetpack Workflow users can seamlessly integrate with other accounting software, including Xero and QuickBooks Online.

Financial Cents’ Pricing

Financial Cents offers two plans. When billed annually, the Team plan costs $39/user per month, and the Scale plan costs $59/user per month.

2. Aero Workflow

Aero Workflow is basic accounting workflow management software with features to help firms manage their client work.

Aero Workflow’s Key Features

1. Task Status Tracking

Aero Workflow users get an overview of the current status of all in-progress work.

Does Jetpack Workflow have this feature?

Yes. This core feature is one that Jetpack Workflow users love. You can review your team’s current and upcoming work with the “My Work” tab.

2. Template Library

Aero Workflow gives users access to their template library of pre-built checklists and workflow procedures.

Does Jetpack Workflow have this feature?

Yes. Jetpack Workflow has an expansive library of over 70 pre-made templates that you can access. You can also create your own custom templates for recurring tasks.

Aero Workflow’s Drawbacks

1. Poor Customer Service

Aero Workflow users report poor customer service experiences when trying to get support.

Jetpack Workflow takes pride in the comprehensive support we offer users. Our quick response times average less than 30 minutes.

2. Dated Interface

Some users find Aero Workflow’s outdated and clunky interface difficult to navigate.

We built Jetpack Workflow to be an intuitive platform that’s simple to navigate, with a sleek, modern feel that forward-thinking firms often seek.

Aero Workflow’s Pricing

Aero Workflow has three paid plans. When paid annually, the Sole Proprietor plan is $39/month, the Small Firm plan is $79/month, and the Large Firm plan is $149/month.

3. Keeper

Keeper is practice management software for bookkeepers and accountants with tools for client, team, and workflow management.

Keeper’s Key Features

1. Team Collaboration

Users can manage all client work within Keeper, allowing teams to collaborate on current tasks and track their progress.

Does Jetpack Workflow have this feature?

Yes. Jetpack Workflow allows your team to collaborate and send messages from right inside the platform.

2. Client Portal

Keeper has a native client portal to answer client questions and request client information.

Does Jetpack Workflow have this feature?

Jetpack Workflow doesn’t have a client portal feature, but there are countless ways to integrate your CRM into our platform using Zapier.

Keeper’s Drawbacks

1. Needs Better Email Integration

Some users share that they wish Keeper had better email integrations because the in-app messaging does not fully replace the need for sending emails.

In Jetpack Workflow, you can forward emails and set up new tasks directly from your inbox. Further email integrations are possible using Zapier.

2. Clunky File Storage

Users say they would prefer more intuitive client file storage within the Keeper platform.

In Jetpack Workflow, you can add unlimited client documents and content to the platform. Our setup makes it easy to find files whenever you need them.

Keeper’s Pricing

Keeper’s Standard plan is $8/client per month, and their Premium plan is $10/client per month. There is also a flexible Enterprise package for larger firms.

Why Jetpack Is Still The Best Accounting Workflow Software

While typical alternatives to Jetpack Workflow also have great features, it might not best fit your current workflow and automation needs.

Here’s some Jetpack Workflow features that make it easy to get your client work done on time, every time.

Create workflow templates in seconds.

Organize and standardize your checklists using our template builder or use any of the 70 free templates in our library. Apply any template to a client with one click.

Automate your critical deadlines.

Set jobs to repeat automatically using a variety of our custom scheduling functions. You can work with confidence, knowing you’ve hit all of your important deadlines.

View all of your client work in one place.

Easily filter, sort, and search through your jobs so you can always find what you’re looking for and get the work done.

See what’s coming down the pipe and stay on track.

Always know what’s up next for you and for your staff. Use your “My Work” page to find out what tasks are up next for you, or to see what your team has on their plates.

Increase efficiency and monitor firm progress.

Get a measure of how much work has been completed and what’s ahead so you can identify any needs early and make a plan for what you need to do next.

But there’s even more:

- Integrate with over 2k apps

- Billing sync with QBO

- Create jobs from your email

- Unlimited clients & docs

- New tracking reports

- Team collaboration

- Calendar view

Schedule your demo or you can start your 14-day free trial.