How To Improve Your Firm’s Accounting Processes & Procedures

Accounting is a field of repetition. Though there are often one-time events, most accounting procedures are repeated regularly—whether monthly, quarterly or annually.

The problem is that it’s easy to create inefficient processes because “that’s how you’ve always done it.” Taking the time to improve how your team operates might be just as important as what your team actually does.

We’ve compiled some top tips to help you and your employees streamline your accounting processes and work more efficiently.

1. Automate your accounting processes

If you haven’t already done so, now is the time to automate your clients’ accounting systems. You should set up their accounts to download transactions directly from their financial institutions to minimize data entry. QuickBooks Online and other popular accounting software allow you to import statements directly along with transaction data.

If you can’t automatically import transactions or required statements, you should request that your clients allow you read-only access to their financial accounts. Doing so will allow you to receive their statements without having to hound them each month. It also means you can complete the work on your schedule instead of scrambling if a customer gets you information later in the month.

Note that automating the import of transactions requires your team to review and ensure the transactions are correctly categorized.

2. Automate your workflow management

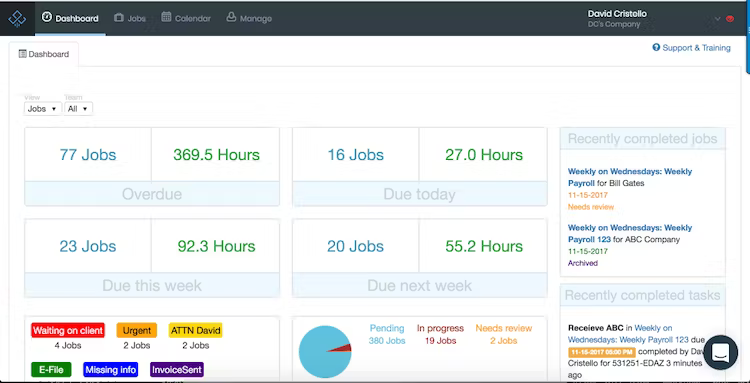

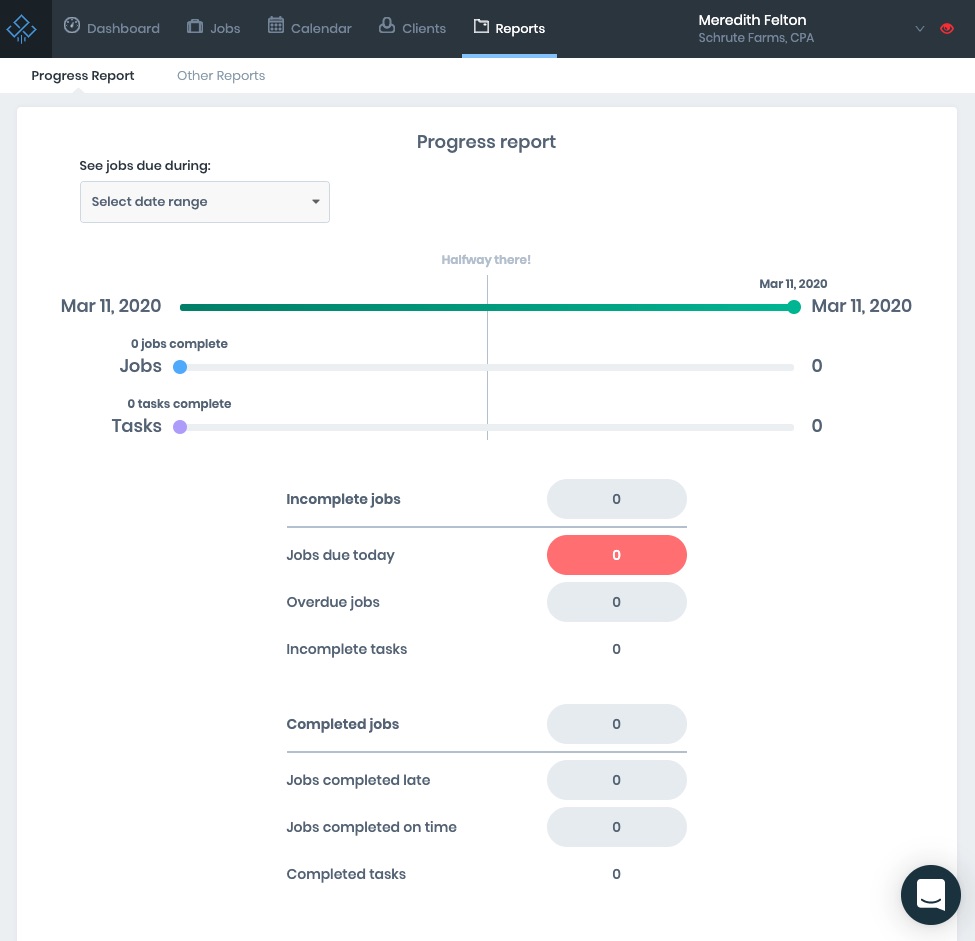

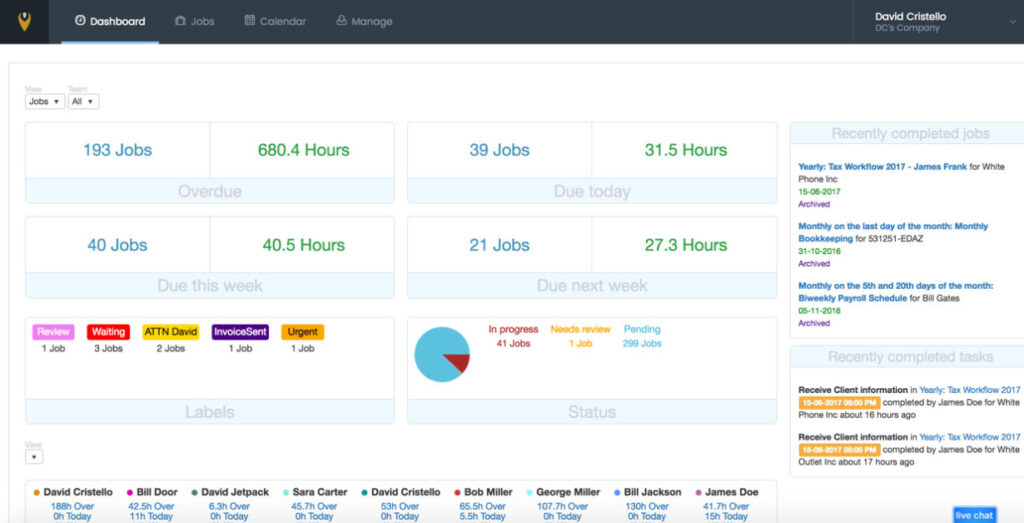

Accounting tasks tend to occur on a recurring basis. Knowing who on your accounting team is responsible for handling different aspects of your client engagements and being able to track the status of those tasks is key to managing your team and keeping your clients happy.

A workflow management system, like Jetpack Workflow, allows you to create reusable templates for client workflows and recurring tasks. These tasks can be assigned to different team members, and you can monitor process completion.

Jetpack Workflow was designed with accountants in mind and contains predefined templates for common accounting tasks.

If you’re not quite ready to check out Jetpack Workflow, access our collection of 32 customizable accounting workflow templates and checklists here. This free resource includes a ton of the most popular accounting templates including monthly bookkeeping, weekly accounting analysis, client onboarding procedures, and common tax return forms.

3. Review your financial records regularly

Along with reconciling your clients’ financial accounts regularly, you should also review their financial statements. Comparative balance sheets and profit and loss statements can identify accounts that need to be updated.

Additionally, you should meet with your clients regularly to verify that you have received all necessary information and that they are aware of their financial results for the year. This allows them to work with their tax professional to avoid unexpected balances on tax day.

4. Hire additional resources

Accounting is a very cyclical job, regardless of the type of accounting you do. For bookkeepers, the beginning of the month is often the busiest time as statements start rolling in. For tax accountants, spring is the busiest time of the year.

Though it’s tempting to run with a skeleton crew during the slower periods, hiring additional staff can make the busy periods more manageable.

If you can’t swing extra staff during the slower periods, you should consider hiring and onboarding new staff a month or two before you need them to ensure they can hit the ground running when the onslaught starts.

5. Evaluate your software

One area that often needs regular evaluation is your accounting software and accompanying digital tools. As your business grows, your needs will change, and new features may become available that can save you time and money.

Your tech stack is one of those things that either creates amazing leverage in your business, or it’s the cause of many inefficiencies. It’s extremely common to outgrow your tools, so regularly evaluate your software with your team to make sure it’s still the best fit for your business.

Since your team uses the tools every day, they’ll have the best feedback in terms of what’s missing from each and which features would help them work better. Use those findings to evaluate your options and make the switch to something new if needed.

6. Stay organized

As an accounting firm, efficiency is key. You need to be able to keep track of all your clients’ financial information and have it readily available at a moment’s notice. This is why staying organized is so important. When everything is in its place, you can quickly find what you’re looking for and get back to work.

Additionally, staying organized ensures that you don’t miss any important details. It might seem like a lot of work to keep everything in order, however it’s worth it when it comes to running a successful accounting firm.

7. Stay up-to-date with client books

It may go without saying, but one of the most important aspects of working efficiently is keeping your clients’ books up-to-date. The longer you wait to reconcile bank statements or ask for backup documentation, the harder it is for your client to locate the necessary paperwork and financial data or answer questions about a transaction.

Staying up-to-date means regularly reviewing and updating your clients’ financial records, bookkeeping methods, and tax reporting requirements. Doing so will help you avoid potential problems down the road and keep their finances in good order. Plus, you won’t have an end-of-year rush to clean up the books before tax returns are due.

8. Build in research time

Many accounting firms spend a lot of time on research. They want to be sure that they are using the most efficient processes and that they are up-to-date on the latest changes in the industry. This research can save the firm time and money in the long run. By being proactive and constantly learning, firms can avoid potential problems in the future.

In addition, research can help firms identify new opportunities for growth. By keeping up with the latest trends, firms can position themselves to take advantage of new markets or services. Ultimately, research is a good use of time for accounting firms because it can help them avoid problems, identify new opportunities, and improve their overall efficiency.

9. Identity bottlenecks

Before you can identify bottlenecks in your accounting processes, you need to understand how those processes work. To identify bottlenecks, you’ll need to take a close look at each step in your accounting processes and ask yourself whether there are any potential delays.

For example, do you need to collect invoices from multiple departments before you can input the data into your financial system? Do you have to wait for approval from upper management before you can issue payments?

By identifying potential bottlenecks, you can start to look for ways to streamline your accounting processes and improve efficiency.

10. Limit reporting to only include useful reports

Over time, the number of reports required by clients can expand. Once a report is run, it often gets added to the regular reporting. However, any reporting packets produced for clients should be regularly evaluated to determine whether the reporting is still appropriate and still being used by the client.

If the reports are no longer relevant, you can omit them and clean things up.

11. Outsource work that isn’t in your wheelhouse

Sometimes you can save money by hiring an expert to do certain projects.

For example, if you are a tax accountant but only produce 1-2 estate tax returns each year, the process may take you longer than an expert in the area would take. When you calculate your hourly rate against the expert’s cost, you may find that you save money by spending money.

You will free up your time to work on client projects that you can do efficiently and effectively.

12. Stay up to date on tax law changes

Tax laws are constantly changing, so staying current on the latest developments is essential. Keeping abreast will ensure your clients are compliant with the law and not overpaying or underpaying their taxes.

In recent years, small businesses have had several grant and loan opportunities. Each business needs to monitor its eligibility and ensure they are meeting applicable deadlines for claiming credits or securing funding. Accounting professionals are often responsible for walking clients through these processes.

Along with federal programs, many states have made short- and long-term changes to their tax codes to assist small businesses during the pandemic. For example, California waived the first-year tax on new LLCs for 2021 and 2022 to encourage new businesses within the state.

Though most accounting professionals are on mailing lists that give frequent updates on changes to laws, larger firms may want to designate one or two people to be responsible for informing the firm of changes and providing summaries of important changes.