A Free Accounts Payable Template (Excel & Google Sheets)

Cash flow is king for every business, which is why many organizations try to stretch supplier payments. It helps keep money in your business and channel it to other, more pressing business needs.

Unfortunately, you can only stretch these payments as far as the agreed terms before receiving calls from angry vendors. Even worse, late payments could lead to penalties and ruin your business’s credit score.

That’s why keeping tabs on all your supplier invoices is essential for ensuring they don’t fall past due. An accounts payable ledger helps you keep your accounts payable transactions in order so nothing falls through the cracks.

In this article, we’ll discuss what an accounts payable template is, the line items it should have, and alternatives to using a manual template.

What Your Accounts Payable Template Should Include

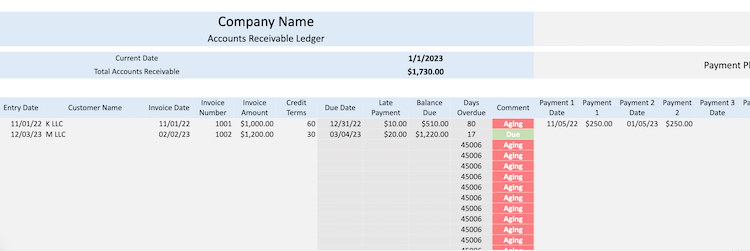

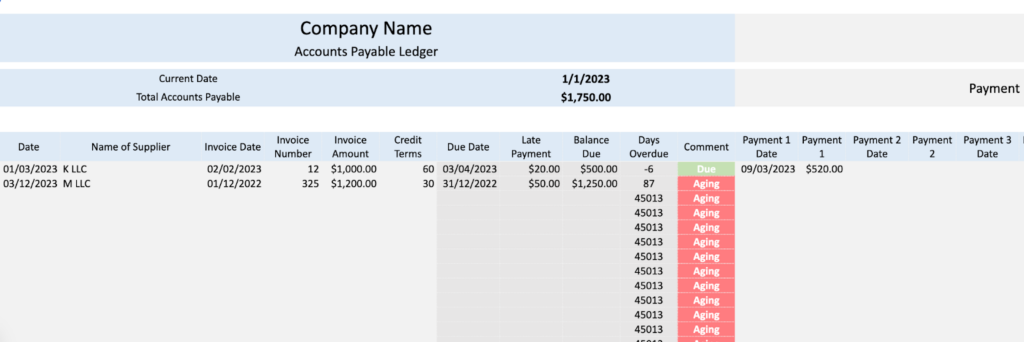

The accounts payable ledger is an aging report that allows you to track the payments and due dates for all your supplier’s invoices. It also tells you the total outstanding amounts your company owes to its vendors at any moment.

Whether you are creating an aging template from scratch or using our free download, there are essential items your accounts payable (AP) aging ledger must have, including the following:

- Name of the supplier: Listing the vendor’s name makes it easy to identify and differentiate between each line item, especially if you have suppliers with similar names.

- Date of the invoice: This section indicates the date the supplier billed you for goods or services delivered or offered. The invoice date will help you estimate the payment due date based on the agreed credit terms with the vendor.

- Invoice number: Every invoice has a unique identifier, the invoice number. It will help track payments, reconciliations, and relevant information about each invoice.

- Invoice amount: This section reports the total amount owed to the supplier. It’s the amount at the bottom line of the vendor’s invoice.

- Credit terms: These payment periods indicate the number of days a vendor’s invoice can remain unpaid. It will help you calculate the due date for the invoice.

- Due dates: This section shows the deadline for paying the supplier. Some suppliers have a due date indicated on the invoice. However, some suppliers don’t provide this, leaving you to calculate the due date based on the payment terms.

- Date of payment: This column records the date you pay the vendor. It helps to have several payment columns to help record different dates of payments.

- Balance due column: Here, you’ll see how much you have left to pay the vendor. If you made a deposit or are paying in installments, this column deducts the payments from the total invoice amount. Our accounts payable Excel template below is dynamic with formulas that auto-calculate this amount for you.

- Total accounts payable: This column sums up the amount you owe all your suppliers. If you use a dynamic spreadsheet, the total amounts will auto-sum based on the balances for each supplier.

- Days overdue: Finally, this column will help track the days a supplier’s invoice is past due. Knowing how many days an invoice is past due allows you to calculate extra costs if the supplier charges a late fee or penalty.

Free Accounts Payable Template

Our free accounts payable template lets you stay on top of all your supplier payments.

The template is easy to use with dynamic formulas that auto-calculate supplier balances and the total accounts payable:

- Download in Excel

- Download in Google Sheets

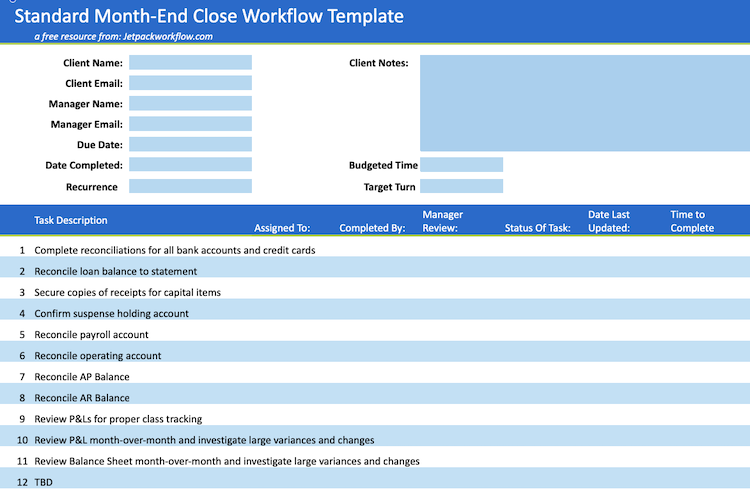

BONUS: Simplify Your Accounting Workflows with This Free Resource

If you’re looking for simple workflow templates to stay on top of your projects and tasks for clients, access our collection of 32 customizable accounting workflow templates and checklists here. This free resource includes a ton of the most popular accounting templates including monthly bookkeeping, weekly accounting analysis, client onboarding procedures, and common tax return forms.

Alternatives to Manually Keeping Track of Accounts Payable

While manual templates will help manage a business’s financial records, things can quickly get out of hand as your business expands. At this point, you will need an accounts payable (AP) managing tool for collaboration and digitizing the process.

Accounting software providers have enabled businesses to automate manual bookkeeping and accounting processes, including AP processes. Additionally, you can auto-generate financial reports at any particular moment, saving you the time and hassle of manually creating them.

Some of the best accounts payable software solutions include the following.

FreshBooks

FreshBooks is an accounting software for freelancers, self-employed professionals, and small businesses with employees or contractors. It primarily serves construction, legal, IT, accounting, and marketing companies.

Pros

- Affordable plans for small businesses

- Has iOS and Android apps

- Easy to learn and use

Cons

- Not ideal for a large business

- Few customization options

- Additional cost to add more users

Pricing

FreshBooks has four pricing plans with a 30-day free trial:

- Lite: $6.80/month

- Plus: $12.00/month

- Premium: $22.00/month

- Select: custom pricing

QuickBooks

QuickBooks is a widely used accounting software with accounting and finance features for businesses in numerous industries. It includes a bill management feature that makes your accounts payable process seamless, including scheduled and automated bill payments, partial payments, and keeping track of payments using its app.

Pros

- Quick learning curve for beginners

- Several plans to choose from

- App to keep track of expenses on the go

- Robust features

- Allows integration with third-party apps and software

Cons

- Potentially pricey for a small business

- Limited users

- Limited customer support

Pricing

- Simple Start: $15.00/month

- Essentials: $27.50/month

- Plus: $42.50/month

- Advanced: $100.00/month

NetSuite

NetSuite by Oracle is an enterprise resource planning (ERP) accounting software with robust accounting and finance features for medium and large businesses. Its accounting product includes account receivable, accounts payable, asset management, cash management, tax management, payment management, and a general ledger.

In addition, NetSuite’s AP feature has automated the AP process, from the review to the approval and payment of supplier invoices.

Pros

- Versatile features

- Easily customizable to suit your business needs

- Integrates with third-party software

Cons

- No free trials

- A steep learning curve

- Must schedule a consult for a pricing estimate

Pricing

NetSuite prices will depend on your business needs, including the core platform used, optional modules you choose to have, and the number of users.

Need Help Tracking Your Team’s Workflows and Deadlines?

Take your accounts payable workflows to the next level with Jetpack Workflow. With our cloud-based workflow management software, you can streamline your processes, increase productivity, prevent team bottlenecks, and never miss a deadline again.

Learn more and start your a free 14-day trial, and see the difference it can make for your accounting firm.