Compare Financial Cents vs. Jetpack Workflow [2024 Edition]

Every time you think you have a handle on your overwhelmingly-long to-do list, a surprised deadline sneaks up on you…again. It’s getting old dropping everything to put out fires and maintain your sanity (and client satisfaction) at the same time. You know it’s time: time to invest in a workflow management software to help do some of the tracking and thinking for you.

The only problem – which task management software is the best choice for your accounting firm? There’s a false perception that software can do it all, and maybe the right tool can take a significant load off your back. However, only if it’s set up properly, everyone on the team is trained to use it, and it’s intuitive to the way your company operates.

Instead of spending hours, days, and maybe even weeks experimenting with different platforms, you know it’s smarter to do the research up front and make an educated decision about the tool to invest your time in onboarding to your company’s workflow.

We believe we can help you make that call. Here’s a rundown on two workflow software options you may be considering for your company: Financial Cents and Jetpack Workflow.

What Do Financial Cents and Jetpack Workflow Do?

Both Financial Cents and Jetpack Workflow are designed specifically for accounting practices. This is helpful because, as you know from firsthand experience, the way an accounting firm operates isn’t exactly the same as many other businesses.

However, Financial Cents is what’s known as an accounting practice management software. These tools will have many product features, but can be too robust for your firm’s needs. Plus many only offer basic functionality of each product feature to just “check a box.”

However, Jetpack Workflow often gets placed in that category or even compared to those platforms. You will find some minor overlap in features between Jetpack Workflow and accounting practice management software, but it’s not what we are.

Our focus is on solving workflow and project management challenges for accountants and growing firms. It’s the area we found to have the most impact on client work and firm growth.

And accounting workflow management software might be the better place to start at your firm.

A Quick Overview of Each Tool

Let’s take a closer look at both tools.

Financial Cents

Financial Cents is built to help accounting firms hit their deadlines and stay on top of client work.

While many growing teams might rely on spreadsheets and to-do lists, Financial Cents is supposed to be the next step forward in making team management easier, and ensuring client work is delivered on time. You can sync Financial Cents with your email so any requests from clients can be imported directly to the tool. You can also use it as a CRM.

Jetpack Workflow

Jetpack Workflow is built to make workflows seamless within accounting, bookkeeping, and CPA firms. It’s also easily adapted to other professional service work.

It’s core benefit is that workflow is its specialty. Users can quickly get started using a library of custom-fit templates that are designed specifically with accountants, bookkeepers, and CPAs in mind. Jetpack Workflow creates efficiency and can automate many manual tasks, saving hours every week for busy, growing, accounting teams.

The Differences Between Financial Cents and Jetpack Workflow

While both Financial Cents and Jetpack Workflow seem like they could work well for your team, the devil is in the details. What are the features, benefits, and day-to-day use like?

Features

Financial Cents has a few key features. First, this accounting practice management software helps you map out every single service and process within your firm. It also has built-in time tracking. This is helpful when completing hourly work for clients, as all information is self-contained in the platform, making it easy to bill. Invoicing is also a feature.

It also has some client management features to make client relationship maintenance easier than ever, but it’s lacking in the reporting department.

Jetpack Workflow also squarely takes on the challenge of mapping processes, but allows teams to get up and running faster with a large library of quality, pre-made templates. While you can customize these to your team’s workflow, you don’t have to build from scratch.

The platform also includes capacity management and planning tools. Ultimately, the end goal of any workflow software should be to show findings to the manager on how they can optimize their team’s time, and Jetpack Workflow delivers.

Another great feature? Reporting that provides the details needed to see how your team is performing, and where work is at in the process.

Integrations

Financial Cents falls down hard on the integrations front. While it can integrate with email clients like Outlook and Gmail, and it also integrates with QuickBooks Online…that’s it. There are no Zapier integrations, and this means that Financial Cents has to be your main tool and do it all. In reality, this isn’t always the case. Teams may need to integrate with a vast array of other tools to deliver for clients, so this is a major shortcoming of Financial Cents.

Jetpack Workflow has a Zapier integration, so that means the hundreds of apps that also have this functionality will sync with the platform. From QuickBooks Online to Xero, you’re covered with Jetpack Workflow.

Ease of Use

Financial Cents is a simple platform with not many integrations available, and not a lot of reporting available. For this reason, it’s easy to use on a daily basis. However, teams may find its capabilities lacking when the goal is growth and optimization of existing processes.

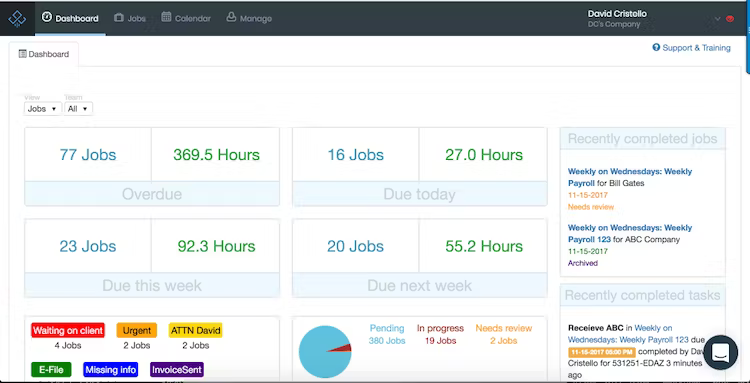

Jetpack Workflow provides users with helpful instructions plus an easy way to get up and running fast: a library of templates designed by accountants, for accountants. Your work can be slotted into a template that’s already built, and you can almost instantly see a difference. It helps you identify and eliminate bottlenecks and track the status of client work easily.

Price

Financial Cents is priced at $49 per user per month for the Team Plan, and $69 per user per month for the Scale Plan. Note that you’ll need the Scale Plan to get things like their Zapier integration and firm branded client portal.

Jetpack Workflow offers two different pricing tiers – $45 per user per month for the Organize plan and $49 per month for the Scale plan. You’ll get unlimited support and training included in both to make setup easy. You can pay annually or monthly. The main difference between the two plans is that the Scale plan includes capacity management and team scheduling.

Customer Service

Financial Cents offers a contact us page on their website, but not a lot of information about ongoing support. They do provide resources like a YouTube channel with information on the product. There’s also a chat feature on the website which users can likely engage with for support questions.

Jetpack Workflow includes training and onboarding within both of its plans. You can also call, email, or chat with the support team at any time and expect a fast response time. You can also try out the platform free for 14 days to see if it truly is a great experience for you and your team.

Wrapping Up

Now it’s decision time: which tool is best suited for your team’s workflow?

Financial Cents is a good simple solution for basic accounting team needs. You’re going to be able to connect to QuickBooks Online and set up repeated, automated tasks. It’s a good fit for a team that focuses on the same type of clients, and the processes are nearly exactly the same for every type of deliverable. If you’re the founder of a very small team, and you need a basic CRM, invoicing, billing, and workflow tracker, this is potentially the fit for you.

Jetpack Workflow is a great fit for a team that wants to automate repeatable tasks, scale growth, and get more out of their day-to-day activity. It’s ideal when a workflow solution is the core reason you’re looking for accounting practice management solutions: you need a centralized platform for client deliverables. Get better reports, more insight, and uncover more opportunities to advance your team’s progress. If you’re interested in taking Jetpack Workflow for a spin, start a free 14 day trial here.