Compare Karbon vs. Canopy vs. Jetpack Workflow [2024]

Workflow software enables businesses to function more efficiently, which results in more productivity. This type of software keeps all tasks, projects, and team members organized so that everything and everyone stays on track. It also saves time and increases collaboration among team members.

So, which software programs on the market have this capability? Karbon and Canopy both fall into this group, and both are worth evaluating. In this post, we’ll compare the similarities and differences between each one.

We’ll also review another tool, Jetpack Workflow, that can specifically help CPA and bookkeeping firms be more productive and organized. It’s a program that acts as the hub for everything else.

So if you’re looking for the perfect accounting or bookkeeping practice management tools, we will compare Karbon, Canopy, and Jetpack Workflow so you can decide which one is right for you.

What do Karbon, Canopy, and Jetpack Workflow Do?

Karbon and Canopy are commonly referred to as accounting practice management tools. These platforms will have many product features, but can be too robust for your needs. Plus many only offer basic functionality of each product feature to just “check a box.”

However, Jetpack Workflow often gets placed in that category or even compared to those platforms. You will find some minor overlap in features between Jetpack Workflow and accounting practice management software, but it’s not what we are.

Our focus is on solving workflow and project management challenges for accountants and growing firms. It’s the area we found to have the most impact on client work and firm growth.

And accounting workflow management software might be the better place to start at your firm.

A Quick Overview of Each Tool

Karbon

This cloud-based collaborative work management platform manages teams and departments inside large organizations or client service businesses. These areas entail accounting, finance, and back-office support.

It’s a collaborative platform that manages workflows, communicates with team members, and delivers the goods. It provides a central place to communicate and collaborate by combining email, discussions, tasks, and workflows.

Canopy

With Canopy, you can manage your team from anywhere. Canopy is a cloud-based platform for accounting firms that need a comprehensive practice management platform to organize teams, workloads, and clients. Canopy offers workflow management, document management, and a client portal.

You can manage urgent tasks on time, increase efficiency on client billing by creating templates for recurring projects. You can also quickly observe assigned tasks and create reminders.

With document management, you can do away with the fax machine, file cabinets, and copier. This efficient way of handling documents reduces waste and increases your team’s efficiency in accessing client files.

The client portal allows you to manage client communication. It also features an intuitive eSign process. The mobile app allows the client to see requests and notifications.

Jetpack Workflow

Jetpack Workflow is a cloud-based platform that focuses on accounting professionals such as staff accountants, CPAs, and bookkeepers. However, they do recognize that any professional service can benefit from this workflow software.

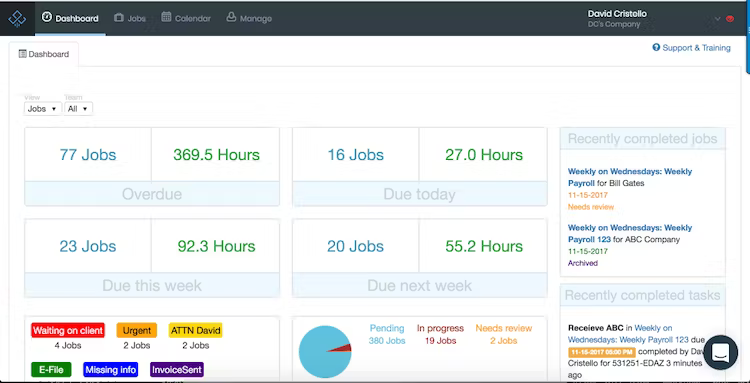

Jetpack Workflow’s software grows with your firm. You can organize your checklists with their free template library, automate critical deadlines with their custom scheduling functions, view all of your work in one dashboard with filters, stay on track with your ‘My Work’ page to see what’s next or what client work your team is focused on, and keep tabs on the firm’s progress.

The Differences Between Karbon, Canopy, and Jetpack Workflow

Now that you have an overview of each tool, let’s look at some of their fundamental differences.

Features

Karbon – Karbon’s key features include automatic client data collection, recurring task generation for regular monthly/quarterly/annual tasks, and document storage for reports, spreadsheets, tax preparation forms, and other documents so that they are in the same place as your workflow process.

Canopy -Canopy has a built-in customer relationship management feature that combines the marketing/sales with the workflow process, an integrated time and billing feature within the system, and a client portal that handles communication and deliverables.

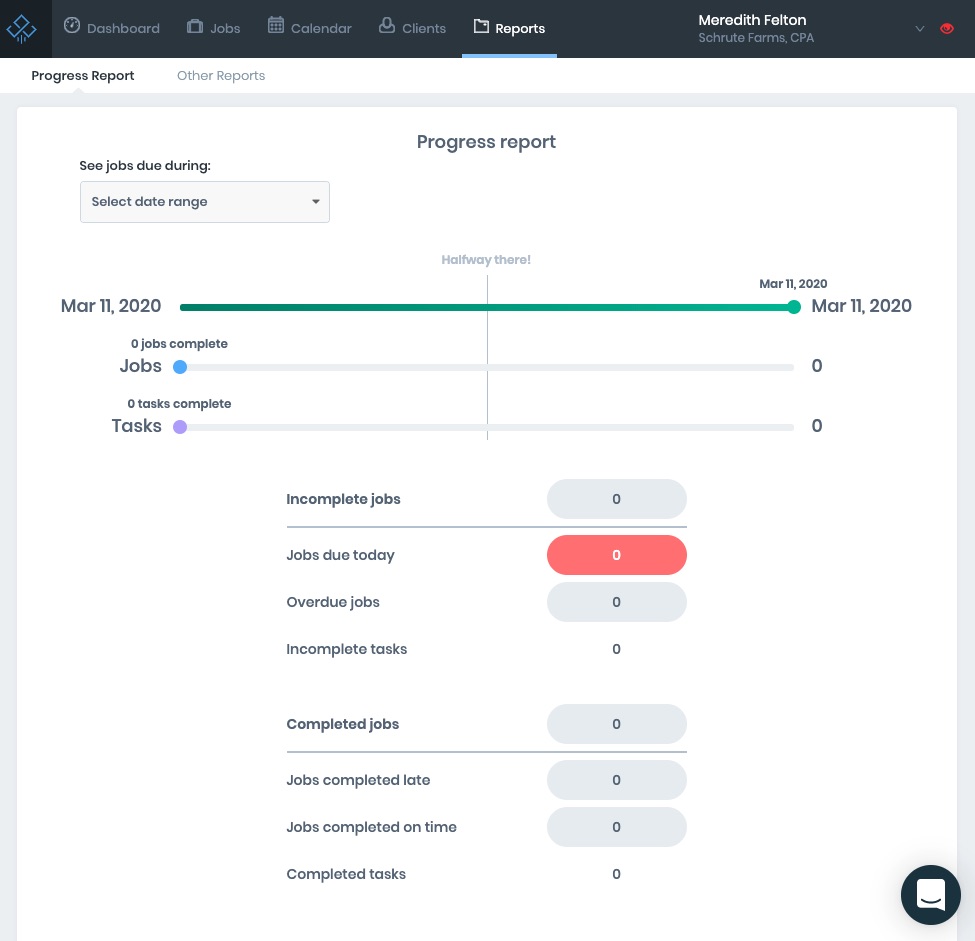

Jetpack Workflow – Jetpack Workflow keeps every workflow process in one location, similar to Canopy and Karbon. It also offers pre-made templates specific to the accounting process, capacity planning tools to allocate your team and resources in real-time and detailed reporting in real-time.

Integrations

Karbon – Karbon consists of 10 direct integrations and a decent amount of “Zaps” in Zapier.

Canopy -Canopy lags behind in this category since there are no direct integrations at this time. Canopy is on Zapier currently in Beta.

Jetpack Workflow – Jetpack integrates and connects all of the tools you currently use and even includes those on Zapier.

Ease of Use

Karbon – Karbon has an above-average interface, but there are some issues with the calendar and email integrations. Some users think the task list is overwhelming.

Canopy -Canopy provides great migration tools, a knowledge base, and a set of tutorials for those who run into problems operating the system. Users did complain about the task feature being clunky.

Jetpack Workflow – Jetpack offers regular webinars, training sessions, a knowledge base, and a support team to help navigate the system. The accounting-specific templates simplify the process of documenting services and processes. The reporting gives you a quick update on where everything stands so that nothing slips through the cracks.

Price

Karbon – Karbon charges per user based on the team or business plan. The Team Plan is $59/user per month if paid annually. The Business Plan runs $79/user per month if paid annually. The price difference is in the additional features. There’s also an Enterprise Plan that is offered at custom pricing for teams of 20 to 20,000.

Canopy – Canopy offers five plans based on modular pricing. The workflow module is $35 per user per month. Additional modules such as document management and time & billing can be purchased separately ($40 per user per month and $25 per user per month, respectively). Additionally, you are charged separately depending on how many contacts you have in your database, and the cost can add up quickly.

Jetpack Workflow – Jetpack offers two simple unlimited plans. Both have workflow features, but the Scale Plan includes capacity management and scheduling features so that you can run all aspects of your business. The Organize Plan runs $45/user per month. The Scale Plan runs $49/user per month.

Customer Service

Karbon – Karbon has extensive resources, a fast response time, and various contact methods such as chat and email but no phone support.

Canopy -Canopy has helpful resources such as video tutorials, webinars, and a knowledge base. Their response time is quick, and they provide multiple contact methods such as chat, phone, and email.

Jetpack Workflow -Jetpack has more than 30 templates for accounting-specific processes in their resource stash, along with tutorial videos and webinars. They have a fast response time if you run into any issues, and they have many ways of staying in touch, such as via phone, chat, or inbox.

Wrapping Up

Jetpack Workflow is designed for smaller accounting and bookkeeping firms and tax professionals, while Canopy caters to mid-sized businesses and Karbon to enterprises.

Canopy is a practice management software for accounting firms that includes project management tools, document tools, a CRM, and communication capabilities. They are the only ones with a billing and invoice feature, which is one of their strengths. However, their integration capabilities seem to lag behind Karbon and Jetpack. Their pricing is based on a modular plan.

Karbon is a work management system that focuses on the workflow automation process with their automatic client data collection. Their software also includes a recurring task generation feature and document storage. While their features are one of their strengths, they lack the approval workflow feature that the other two have.

Jetpack Workflow offers an array of comprehensive features such as pre-made templates that simplify the workflow. These are so helpful for small businesses in growth mode. It also has capacity planning tools for allocation in real-time, and detailed reporting, so you know where every aspect of the business stands. The other benefit is this option has the simplest of all the pricing plans.