9 Ways Your Accounting Firm Can Utilize Automation in 2024

Would you like to take some accounting tasks off your plate and work more efficiently? Are you looking to modernize your firm and implement more automation in your accounting processes? You’ve landed in the right place.

We’re obsessed with finding ways to make your firm more productive, and that’s what this guide will ultimately help you do.

This article will cover:

- What accounting automation is

- The benefits of using more automation in your firm

- Features you should look for when choosing your accounting software

- 13 types of automation for accounting firms (with recommended tools to consider)

Let’s get started!

What Is Accounting Automation?

Accounting automation is a powerful tool to help firms to streamline their processes and save time and money. It links different apps, such as invoicing tools, expense tracking software, and financial dashboards, to automate tasks like creating invoices, reconciling accounts, managing payroll and project deadlines, and much more.

By automating these processes, accounting firms get more done in less time while reducing manual errors associated with repetitive tasks and tedious data entry.

With the right automation strategy, your firm can be more efficient in its daily operations and free up team members for important projects that require more personalized attention and creativity.

Automation also helps keep your clients happy and eliminates lost time due to forgotten tasks or administrative errors.

Choosing Accounting Automation Solutions

There are several factors to consider when choosing an accounting automation software solution.

- Integration with other systems: Ensure your accounting automation solution is compatible with platforms your business already uses, such as customer relationship management and enterprise resource planning software. This will simplify the integration processes and reduce data errors among different tools.

- User-friendliness: Opt for an easy-to-use system that staff can learn quickly, saving them from long and tedious training sessions.

- Scalability: Make sure your chosen solution can adjust to a growing business so you don’t have to replace it when your company expands.

- Cost: Weight the cost of the product against its features and potential return on investment before making a purchase decision. Aim for a solution that offers value and covers all your financial management requirements.

9 Automation Areas for Accounting Firms

1. Client Communication

Traditional methods of communication can be incredibly time-consuming and sometimes lead to ineffective communication or lost messages. Slack solves those problems.

Slack is a messaging platform designed for teams, businesses, and organizations. It has features like creating channels by topic or project, direct messaging between team members and other network users, easily finding past conversations with searchable archives, setting reminders for team members, and more.

Accounting firms that need to communicate frequently with monthly clients find Slack offers an easy-to-use solution. Its user-friendly interface and array of tools make it perfect for quickly sending updates, requesting documents, and sharing vital information. Firm owners can keep their entire team up-to-date in real time with the platform’s powerful messaging features.

In addition, Slack’s mobile app makes it easy for both teams and clients to stay connected no matter where they are. It allows firms to provide fast customer service and respond quickly to client inquiries, ensuring they promptly meet each client’s needs.

2. Invoice Automation

Getting clients billed correctly and on time can be difficult without proper invoice generation and management processes. It can lead to cash flow issues when payments are not received or get missed due to a lack of follow-up.

Thankfully, tools are available to streamline this process of creating and managing client invoices, eliminating these potential issues. Two popular invoice automation systems for accounting firms are Zoho Invoice and FreshBooks.

With Zoho Invoice, you can quickly create professional-looking invoices using their pre-populated templates. You can also add notes and messages to your invoices, helping maintain client relationships. The software also has a multi-currency feature, allowing you to send invoices in different currencies and track payments in real time.

FreshBooks is another invoice automation system to consider. Features include setting up recurring billing, tracking expenses related to projects, generating reports on income and expenses, and creating custom estimates. You can also integrate FreshBooks with popular apps like QuickBooks for seamless data transfer between services.

3. Workflow Automation

Several client workflows typically need to be managed at an accounting firm. These include onboarding new clients, tracking open items throughout a project, documenting client feedback from review meetings, creating monthly invoices, following up on overdue payments, and closing out projects.

These steps are vital for providing quality client support and ensuring the firm’s success. At its core, workflow automation helps you streamline your processes to save time and money, reduce manual data entry, and focus on more important tasks.

- Improved accuracy and reliability of financial reports: Automation allows for the elimination of manual data entry errors, ensuring all accounts are balanced correctly.

- Increased productivity: Automated processes save time by eliminating mundane tasks such as sorting through paperwork or entering numbers into databases. This lets staff focus on higher-value tasks such as periodic audits or consulting services.

- Streamlined client onboarding process: Automating the onboarding process helps new clients get set up faster in the firm’s systems, reducing administrative burden and increasing efficiency in the long run.

- Increased compliance and control over finances: With automated processes, firms can easily ensure their clients remain compliant with industry regulations.

- Enhanced customer service: Automating administrative tasks and financial processes can free your staff to focus on providing better customer service and responding to inquiries promptly.

- Improved scalability: Automation allows firms to scale their services quickly and easily, allowing them to take on more clients without adding headcount or resources.

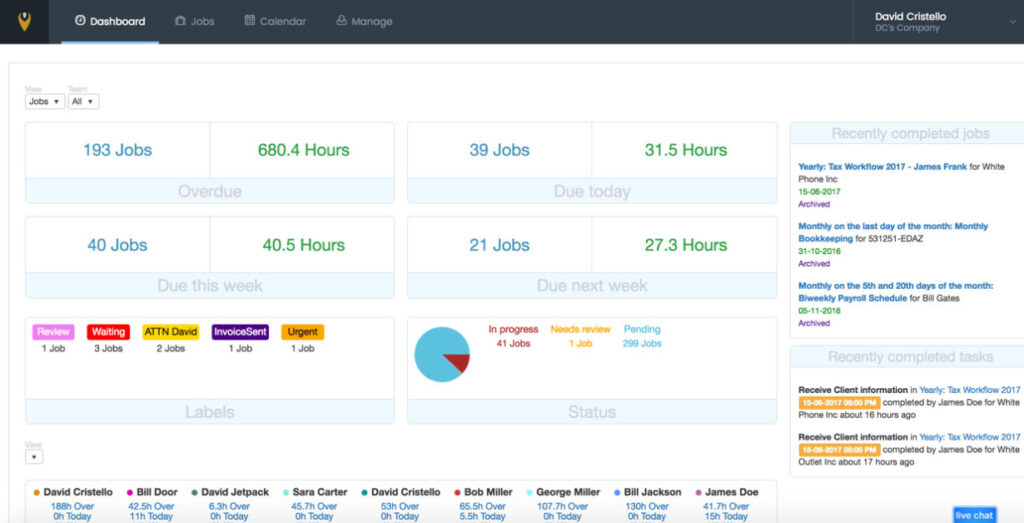

When it comes to accounting workflow automation, Jetpack Workflow is the perfect solution for accounting and bookkeeping businesses. It is a powerful platform with features like customizable templates, recurring tasks, workload monitoring, and more.

With over 6,000 accountants and bookkeepers already using Jetpack Workflow, it’s easy to see why this product is so popular. Learn more and start a 14-day free trial here.

4. Bank Reconciliation

Bank reconciliation can be incredibly labor-intensive for accounting and bookkeeping firms, particularly when managing the bank accounts of dozens or hundreds of clients. If bank statements aren’t reconciled accurately, it can create significant problems for the client and the accounting firm.

For the client, inaccurate reconciliation could lead to misallocating funds or other errors that could cause financial losses. For an accounting firm, an incorrect reconciliation could result in a damaged reputation and potential legal liability.

When errors are found, quickly identifying and addressing them helps resolve any potential issues before they have a detrimental impact. However, manual reconciliation processes leave room for human error and are time-consuming tasks preventing firms from delivering an accurate financial picture to their clients on time.

To ensure the accuracy of their bank reconciliation process, firms can leverage tools like BankRec and AutoReconcile. These systems enable users to match transactions in their accounting system with corresponding entries in the bank statement.

BankRec allows users to upload a CSV file containing their client’s bank transactions from the past month. The tool then matches each transaction with its corresponding entry in the user’s accounting system, helping the user quickly identify and address any discrepancies.

AutoReconcile is another useful automation tool. The software automatically reconciles all transactions between two sets of records (e.g., an external bank statement and an internal accounting system) by matching the date, amount, payee, currency, and more. This process helps to ensure accuracy and speed up the reconciliation process significantly.

5. Payment Collection Automation

Manual bill payment processes can be tedious and inefficient for accounting firms. Collecting payments the old-fashioned way requires a lot of paperwork and manual tasks like data entry and tracking customer records.

As a result, the risk of errors increases in processing payments. Double charges could occur if someone neglects to update the system after manually entering information.

On the other hand, automating bill payments with tools such as Bill.com and QuickBooks Payments can streamline the process by eliminating unnecessary steps and reducing the time needed to collect payments. Automation also eliminates the risks associated with manual processes, increasing accuracy and security regarding customer records.

In addition to simplifying and securing accounting processes, automating bill payments also provides a better experience for clients. Automation can reduce the time from when the customer authorizes a payment to when the transferred funds land in the firm’s account.

6. Financial Reporting Automation

Financial reporting is another labor-intensive process. Accounting firms and bookkeepers often spend lots of time manually entering data, validating numbers, performing calculations, and preparing financial statements.

This amount of labor employs valuable resources that could be put toward growing the business or providing other accounting services to clients instead.

Xero and QuickBooks are two popular examples of financial reporting automation tools many accounting firms use today. Accountants can create financial statements from data stored in the cloud, such as cash flow statements, balance sheets, income statements, and trial balances.

Using these automated reporting systems helps speed up the reporting process, saving time and money while still providing accurate financial information.

Automated financial reporting tools also make spotting trends and potential issues in a client’s finances easier. Accountants can quickly identify cash flow changes, assess a business’s health, and make better decisions based on reliable data.

Furthermore, these tools provide accounting firms with an efficient way to monitor their clients’ finances, allowing them to deliver more customized solutions that meet their customers’ needs.

7. Client Reminders Automation

In a recent interview on the Growing Your Firm podcast, Brian Clare, co-founder and CEO of Blueprint Accounting and the “Zapier Guru” of the accounting industry, said, “Losing the ability to automate client reminders would break my heart if Zapier went away.”

Many accounting firms struggle to gather necessary information from their clients, leading to costly delays and lost opportunities. It’s time-consuming for the client and the firm since it involves a lot of back-and-forth communication, often resulting in incomplete or outdated data being submitted.

To overcome these challenges, Brian uses Zapier and the email automation service ActiveCampaign to:

- Request clients to send bank statements each month for reconciliation

- Send clients an email just before month’s end reminding them he’ll need their receipts

- Set client-specific reminders, such as logging into their account to share a file

Brian notes that, for the most part, clients respond faster when they receive automated email reminders.

8. Time Tracking Automation

Accurately tracking the time each client account requires lets firms bill their clients fairly and provides insight into where to make improvements and create more efficient processes. Inaccurate time tracking or underbilling for services can lead to lost revenue for any business, especially in an industry as competitive as accounting and bookkeeping.

Fortunately, excellent automation tools such as Time Doctor and Harvest make time tracking easy. Time Doctor allows you to easily monitor how long each team member works on each task. Harvest enables you to send accurate invoices with an exact breakdown of the hours your team members work.

With these automation tools, you can ensure your clients are always billed accurately for the time spent on their accounts while maximizing your profits by tracking and billing their clients for all services rendered.

9. Client Onboarding Automation

Accounting firms frequently tell us they’re looking for ways to expedite the client onboarding process. There’s a lot of information to collect from the client and quite a few platforms they need to get set up on before work can actually begin.

Brady Meaux, founder of the accounting firm Meaux & Co., described how he’s using Zapier to automate this process when he came on the Growing Your Firm podcast. He said, “New clients can fill out one form, and Zapier will connect all the applications I want that client to be set up in.”

Here’s what happens in the background with Zapier once a new client fills out Brady’s form:

- Sets them up as a contact in Google

- Adds them to QuickBooks Online and ProConnect Tax Online

- Sets up a specific folder structure in Citrix ShareFile

- Creates a new client in Jetpack Workflow and sets up their workflows based on the type of services they’re receiving

You can watch the full interview with Brady below.

Keys to Success When Implementing Automation

How can you ensure success when implementing new automation solutions in your accounting firm? Here are a few best practices to incorporate when introducing new automation solutions to your firm.

- Proper planning and preparation: Before implementing automation, determine what processes need to be automated and have a plan to ensure a smooth implementation. This preparation includes specifying the resources required and setting achievable goals.

- Involving all stakeholders: Involving your stakeholders, including staff, clients, and management, is vital for successfully implementing automation. It will help confirm everyone is on board with the changes and that all perspectives are considered.

- Training and support: Providing proper training and staff support is essential for ensuring everyone is comfortable using the new technology and can perform their tasks effectively.

- Clear communication: Communicate the benefits of automation, how it will impact the firm and its clients, and what the implementation process will entail is critical to ensure a smooth transition.

- Ongoing maintenance and monitoring: Regular maintenance and monitoring of the automation system are crucial to be sure it continues to perform optimally and that you quickly address any issues.

- Flexibility and adaptability: The ability to adapt and make changes to the automation system as needed helps you ensure it continues to meet the evolving needs of the accounting firm.

- Measuring and tracking results: Measuring and tracking your automation results is essential for assessing its impact and making the necessary changes to improve its performance. Tracking can include productivity, accuracy, and client satisfaction metrics.