What No Code / Low Code Means for Accounting Firms

Podcast

Summary

- Who Does LiveCA Serve?

- Team Growth

- Starting a New Team

- Why Did LiveCA Start the Dev Team

- Cost of Automation

- Creating CloudAccountingJobs.com

- Getting Started in Low-Code/No-Code

Additional Resources

- LiveCA

- LiveCA’s Twitter

- Chad Davis—Twitter

- CloudAccountingJobs.com

- Chad’s Previous Interview

- Jetpack Workflow interview with Josh Zweig

- Jason Staat’s “Realize” Community

Meet Chad Davis

Chad Davis is Co-Founder and Partner at LiveCA alongside past Jetpack guest, Josh Zweig. Chad is a CPA. He graduated from Ryerson University with a BCOMM in Accounting and went on to receive an MBA from St. Mary’s University. He also holds a CPA, CMA designation. Following graduation, he became a controller and worked in the Cayman Islands for half a decade.

In 2013, Chad met Josh Zweig and came up with the idea of combining technology and tax under one roof. Since 2013, their team has grown from six team members to more than 100 today! Chad believes that LiveCA stands on the principles of education and knowledge-sharing which makes the company’s interactions with their customers, and each other, that much more interesting.

Who Does LiveCA Serve?

Their client base has changed over the years, but their essential clients are companies with at least $2M in revenue or more or funding that’s at least 12 months on the runway. They offer a wide variety of services to their clients: accounts payable, payroll, bookkeeping, tax, M & A, and trust work, as well as CFO-type services, and generally trying to help their clients as much as they can.

Team Growth

Since 2013, LiveCA’s team has grown from six team members to more than 100 today.

“In the early days, any money was good money,” Chad says. “And we used that to fund the growth of the team.”

However, that model eventually ends up failing. So, what led to his team seeing such explosive growth? In 2018, LiveCA “politely moved off 200–300 customers and added 40.” The result? The company was up more than $1M in revenue that year.

“That’s a testament to really knowing who you serve well and then focusing on them only.”

David chimed in and noted that it’s amazing to see how focusing on a specific client type and offboarding those that don’t fit that description can really drive both top and bottom lines.

Starting a New Team

Chad has spent the majority of his time in the firm focused on the technology side of things. The firm’s dev team only consists of approximately 4% of the company. The team is small simply due to the fact that it started last year with Chad tinkering.

“That tinkering turned into a plan, and that plan turned into moving people around.”

Pretty soon, they had shifted a few people into new roles and backfilled their old ones. It took a lot of planning, but it’s now live. When David asked Chad if he had developers at the firm prior to starting the dev team, Chad said no, that they were internal moves.

“Our project manager, Mat Kennedy, he’s a machine. He’s smart. He started as a bookkeeper mastered that, then he became a trainer, then he led the training team, and now he shifted from the training team to the development side.” A great example of someone moving through the ranks based on their interests and abilities.

Mat went from bookkeeper to no-code/low-code/visual developer in just a few years.

“That just goes to show you that experience isn’t why you should hire somebody,” Chad said. “It’s all about drive, curiosity, and personality.”

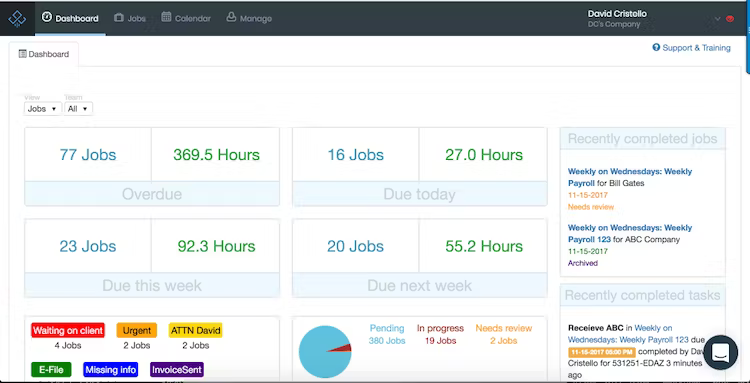

Get everything you need to manage projects and meet deadlines.

Subscribe to our weekly newsletter, and get 32 free accounting workflow templates today! sign me up!

Chad explained, “We noticed that our clients had problems around the way the data moves or the way they use their data.”

The LiveCA team was always the answer, and they would provide solutions either manually or technically – through spreadsheets, Google Sheets, or other tools on the market. The problem with this approach was the amount of time and manual work that was spent on those solutions.

One example of this sticks out in Chad’s head:

“A high-profile medical tech start up that provided virtual care had hundreds of contractor invoices they were tracking in Google Sheets. Then, someone had to format that to get it into Xero, and there were intercompany and multi-jurisdictional issues with the U.S. and Canada, so there were two different Xero files. It was just a mess (and a ton of time) to manually do all of that.”

Chad got on Upwork and put out a query asking for a freelancer to write up a basic, easy-to-use app script that essentially would flag designated data to be moved into Xero from an outside platform. Twenty-four hours later, he had a script. They tinkered with it and then tested it, and it worked! LiveCA has done 50–100 more automations just like that and their customers are immensely happy with it, which is why the dev team is continuing to grow.

Now, you may be thinking that this was probably a huge investment on Chad’s part, but that isn’t the case. The initial script he got off of the freelancer on Upwork cost him $45. Over the last year, they’ve amended that script to do everything they want – getting data out of Google sheets.

Chad’s advice for those just starting out? If you’re using tech solutions like Google Sheets, Zapier, or Integromat, use the built-in watch triggers. Eventually, you’ll likely get tired of dealing with timing issues, duplicates, etc. He advises that it would be easier to just work on Webhooks, as that’s the quickest way to get data from one platform into another.

Cost of Automation

So, what does Chad charge for these automation services? The answer might surprise you.

“A lot of people think very linearly. ‘This is a cost on my end, I should charge for it. This is my time, therefore, I should charge for it.’ If we can do something that creates a more sticky relationship with somebody that leads to more referrals or less time spent or just a really good feeling about us and it takes 5–10 hours, that will pay dividends if it’s the right type of customer.”

LiveCA has only charged a handful of customers for this service and it’s largely due to difficulty of implementation. For Chad and LiveCA, relationships are far more holistic, not just time-in, time-out.

Creating CloudAccountingJobs.com

Chad’s team had never built a fully public-facing app, and they wanted more experience with user management, email alerts, field filters, etc. On top of that, they wanted to help meet a felt need in the industry, and the biggest felt need today is talent acquisition and retention of employees.

They created CloudAccountingJobs.com (CAJ) to help people find those dream firms early, and to help firms fill positions quickly.

“There was never a place where you could search for jobs from that 2–5% of firms that consider themselves innovators,” said Chad.

They built the whole thing on Bubble, and it took them less than 30 hours to create and launch. Right now, there are job postings from firms from all over the world. There’s one key difference that sets CAJ apart from other job posting sites: filters.

Most job posting sites have filters, but they are usually limited to full-time/part-time, salary/hourly, and remote/in-person. CAJ is designed with filters that really matter to accountants, things like vacation policies, retirement perks, apps used, communication methods, and—yes—salary.

“I believe in salary transparency, and I believe that experience shouldn’t be the cornerstone of why you hire somebody,” said Chad.

Job posters aren’t limited to full-time or part-time positions either. You can post freelance jobs, gig work, and seasonal jobs, too. As an employer, this tool is also useful for positioning yourself amongst some of the best in the industry.

Chad says one of the most exciting things they’re working on right now is when a new company signs up and posts a job, they’re given the opportunity to answer questions through a tool called VideoAsk. Those answers will be compiled into a video that will be featured on their profile page and job pages.

Getting Started in Low-Code/No-Code

David asked Chad what advice he would give to those starting out in the low-code/no-code realm. His response was that everyone is different, so everyone will have different needs that will be met by differing platforms. Chad spent six months learning, watching videos, joining communities, getting an idea of how AirTable scripts work. Now, he says that watching 8–10 hours of quality, educational content on Youtube would likely equate to getting enough knowledge to feel comfortable tinkering around.

“If it was me starting from scratch, I would still do the Youtube thing, join a couple of communities (like Realize), and then definitely not start with Bubble. Start with Zapier, start with Integromat, start with Airtable,” explained Chad.

Conclusion

We covered a ton of great information in the podcast, so if you’re after more detailed information, be sure to check out the full episode! If you want to learn more about Chad, his company, and the no-code/low-code realm, you can connect with him on Twitter!